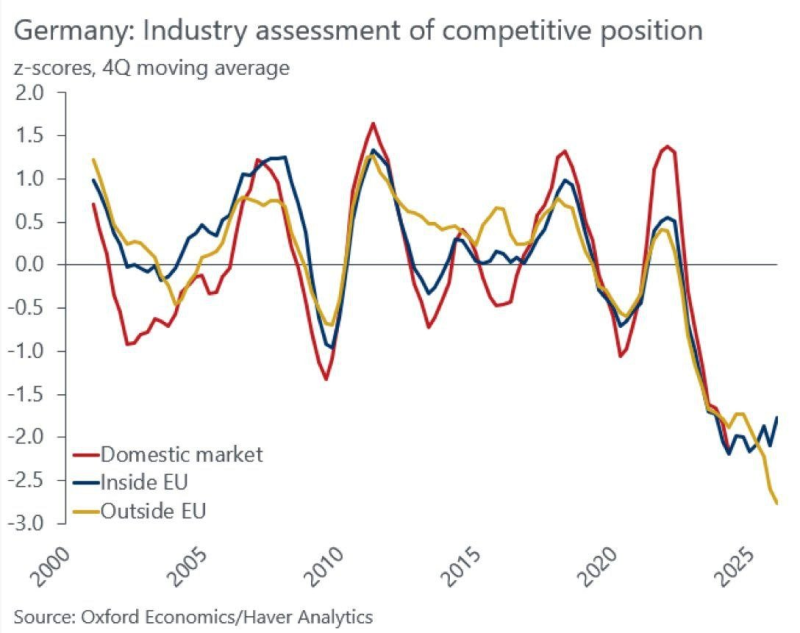

⬤ Germany's industrial competitiveness has dropped to some of its worst readings since 2000. A comprehensive competitive position chart tracking domestic, intra-EU, and extra-EU performance shows z-scores falling sharply below zero across all three segments. This broad-based deterioration signals deep structural strains in Europe's largest economy - not just a temporary dip tied to a single market.

⬤ The chart tells a clear story. The red line tracking domestic competitiveness has plunged deep into negative territory. The blue line representing EU-level positioning sits well below average. And the yellow line for outside-EU performance is showing the steepest decline of all three. Germany has long leaned on strong export sales in vehicles, machinery, and industrial equipment - but relative z-score losses versus global peers suggest that edge is narrowing fast, even where headline export volumes have held up.

⬤ What makes this cycle different is the lack of any obvious rebound catalyst. In the 2000s and 2010s, periods of industrial weakness gave way to recoveries driven by macroeconomic adjustments, technology investment, or shifts in global demand. This time, the simultaneous weakness across all three metrics points to something broader - a mix of rising energy costs, supply chain restructuring, and intensifying competition from lower-cost producers that no single policy lever can easily reverse.

⬤ For markets, this matters beyond Germany's borders. The country's economic health is tightly linked to the wider Eurozone and major benchmarks like the DAX. A sustained drop in competitiveness weighs on corporate earnings for export-oriented firms, drags on EU growth expectations, and shapes broader sentiment toward European assets. With Germany sitting at the center of European supply chains, these metrics will stay firmly on analysts' and policymakers' radar in the months ahead.

Peter Smith

Peter Smith

Peter Smith

Peter Smith