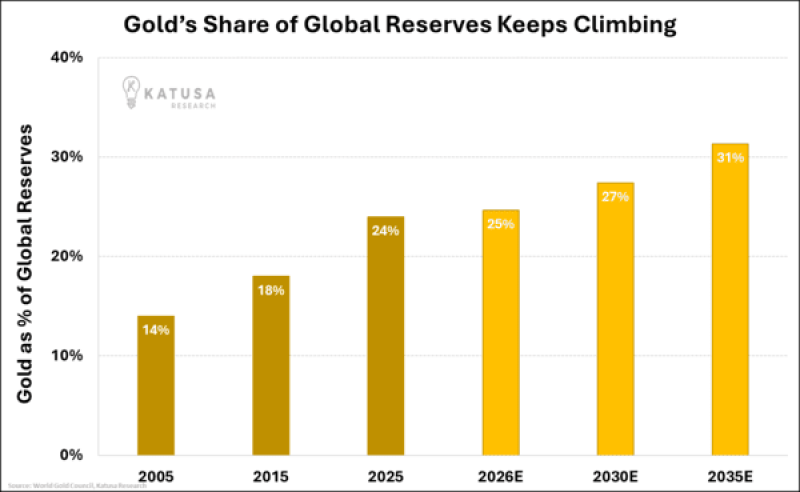

⬤ Central banks now buy gold at the fastest pace since 1971. Twenty years ago gold formed 14 percent of global reserves - today the share reached 24 percent and analysts expect 25 percent by 2026, 27 percent by 2030, perhaps 31 percent by 2035. In the early 2000s the same institutions were selling gold.

⬤ From 2002 - 2010 they sold about 140 million ounces. The 2008 crisis reversed the pattern - every year since then they have been net buyers. The buyers are not minor states but NATO members, EU founders, close allies of the United States. The move from paper claims to metal stored in vaults signals a new view of what counts as secure.

⬤ The share rose from 18 percent in 2015 - 24 percent in 2025. Banks no longer treat gold as a simple hedge - they treat it as a declaration. Geopolitical friction, currency swings and broad uncertainty drive them toward an asset they can hold plus count. The future milestones rest on strategies already agreed and under way, not on hopeful guesses.

⬤ This shift reshapes world finance. As gold occupies more of reserve portfolios, its role in currency hedging, liquidity management and strategic planning expands. The movement is not a brief surge - it is a structural change that restores gold to a central place in the monetary order while the global economy moves through a major transition.

Peter Smith

Peter Smith

Peter Smith

Peter Smith