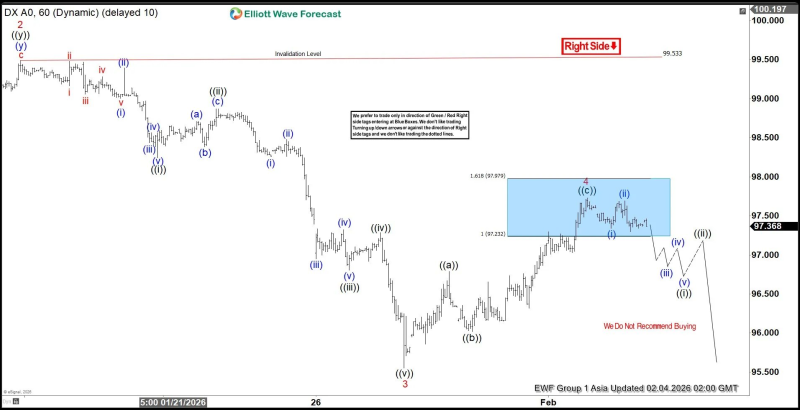

⬤ The U.S. Dollar Index keeps leaning toward further losses after locking in a lower low on the daily timeframe. Price pulled back from a critical reaction zone marked on the chart, strengthening the case for continued weakness. DXY is responding from the identified Bluebox area and looks set to deliver at least a three-wave drop, with 95.04 standing out as the primary downside objective.

⬤ The chart reveals the broader Elliott Wave setup, positioning DXY inside a corrective phase following its earlier decline. The Bluebox zone represents a high-probability area for the downside move to resume rather than spark any meaningful rebound. Price behavior here has played out as anticipated—the index couldn't regain upward traction and instead rolled over again, confirming the underlying weakness.

⬤ Based on the projected pathway, the dollar index might either head straight for 95.04 or first work through a corrective three-wave bounce before pushing lower. The daily trend stays bearish, with the pattern of lower highs and lower lows still intact. There's no sign of reversal or upside breakout on the chart, keeping traders focused on downside development from this reaction zone.

⬤ This technical picture matters because shifts in the U.S. Dollar Index ripple across currency pairs, commodities, and global risk appetite. Sustained DXY weakness reshapes relative currency strength and touches correlated assets across markets. With price already confirming a lower low and forecasts pointing toward 95.04 or below, the current structure highlights real downside risk in the dollar's near-term path.

Usman Salis

Usman Salis

Usman Salis

Usman Salis