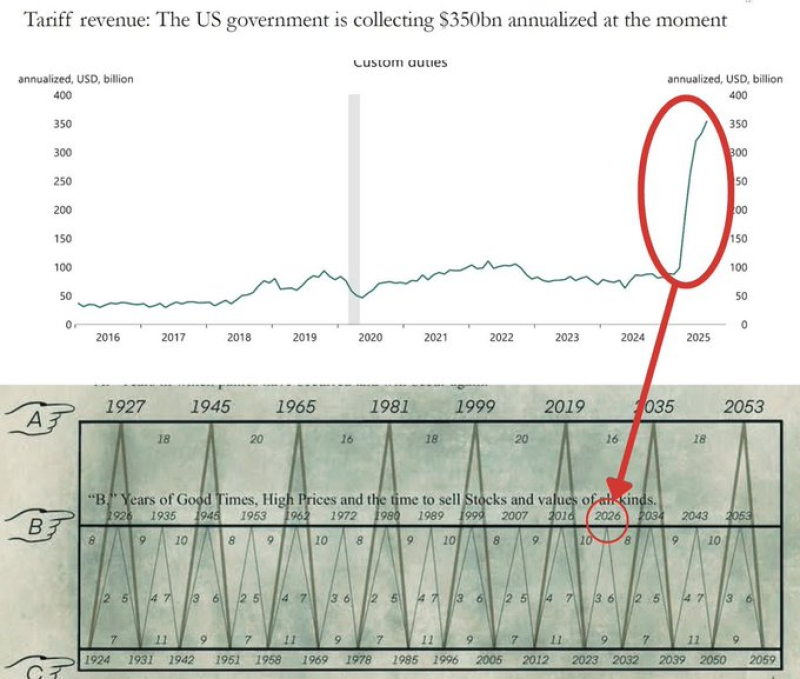

⬤ A landmark Supreme Court decision has declared major Trump-era tariffs unlawful - and markets are paying attention. According to recent data, the U.S. government was pulling in roughly $350 billion annually in tariff revenue, with some estimates putting total cumulative duties closer to $600 billion. That's far beyond historical norms, and the question now is simple: what happens to all that money? As Wimar.X put it, "the ruling doesn't just change future policy - it reopens the books on everything collected so far."

⬤ The court's ruling invalidates tariff authorizations under specific legal frameworks, leaving fiscal authorities to sort out a messy situation. Will some of that revenue be refunded? Will new tariffs emerge under different legal grounds? JPMorgan has already flagged that SPX faces meaningful volatility as markets reprice trade policy risk - and retaliatory moves from trading partners add another layer of uncertainty.

⬤ From a macro standpoint, tariff flows of this scale touch everything - liquidity, trade balances, import pricing, and inflation expectations. If those revenues shrink or get reversed due to legal constraints, budgetary projections shift, and markets have to reassess U.S. fiscal balance from scratch. That kind of repricing tends to ripple across currencies, equities, and risk assets like BTC. Trump has already warned about the consequences of losing tariff authority, signaling the political fight is far from over.

⬤ The bottom line: this ruling introduces real legal and fiscal constraints on one of the most aggressive tariff periods in modern U.S. history. How policymakers respond - through refunds, new legislation, or redesigned trade tools - will shape risk sentiment across major asset classes for months to come.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi