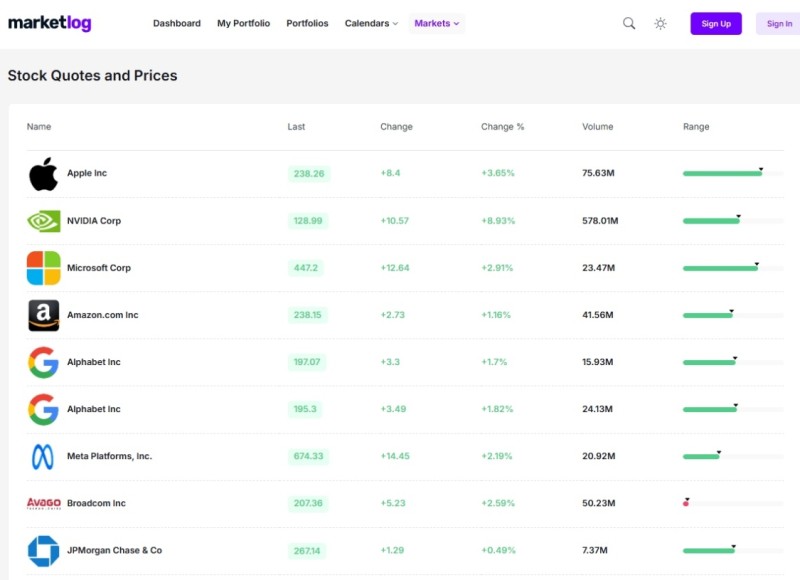

Despite concerns about competition, the growing adoption of AI is expected to drive long-term gains for leading technology companies such as Apple (AAPL), Nvidia (NVDA), Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOG). As these firms adapt and innovate, stock quotes show a strong upward trend, reinforcing investor confidence.

DeepSeek’s introduction of a cost-efficient Language Learning Model (LLM) is a significant milestone. Unlike traditional AI models requiring expensive Nvidia chips, DeepSeek operates with cheaper hardware and is open-source. While this disrupts the status quo, it also accelerates AI adoption across industries. Companies that previously faced high barriers to entry can now integrate AI at a lower cost, potentially enhancing productivity and profitability.

For investors, tracking stock performance in real-time is crucial. With AI reshaping the landscape, monitoring price movements, earnings reports, and valuation trends helps make informed decisions. Investor tools like Marketlog.com offer a comprehensive tracker to follow stock charts and analyze trends effectively. By leveraging such tools, investors can stay ahead of market shifts and capitalize on opportunities.

One key concern is whether AI-driven changes could lead to a market downturn. Historically, bear markets have been linked to recessions or monetary tightening by the Federal Reserve. However, experts believe DeepSeek’s emergence is not a "black swan" event that could trigger a financial crisis. Instead, it represents a "gray swan"—an unexpected event with both risks and opportunities. While some tech firms may face short-term adjustments, the broader market is likely to benefit from increased efficiency and lower AI infrastructure costs.

Furthermore, valuation concerns surrounding the Magnificent Seven stocks—Apple, Microsoft, Nvidia, Amazon, Alphabet, Meta, and Tesla—continue to be debated. Some analysts worry about a potential bubble, comparing today’s AI hype to the dot-com era. However, strong earnings growth projections suggest that these companies remain well-positioned for the future. If AI-driven productivity boosts profits across industries, even stocks outside the Magnificent Seven could see gains.

Looking ahead, investors should focus on key indicators such as corporate earnings, Federal Reserve policies, and AI adoption rates. While uncertainties exist, the potential for AI to drive long-term economic growth remains promising. By staying informed and using advanced tracking tools, investors can navigate market fluctuations with confidence.

As AI continues to evolve, its impact on the financial landscape will be profound. The key takeaway? Embracing technological advancements while making data-driven investment decisions can help maximize returns in this rapidly changing environment.

Editorial staff

Editorial staff

Editorial staff

Editorial staff