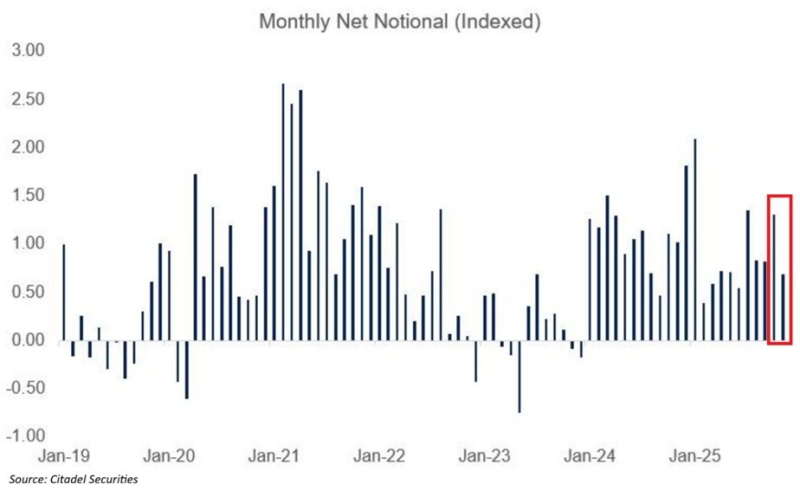

⬤ Individual investors continue a buying streak that has become one of the longest in recent market history. They approach their 23rd consecutive month of net stock purchases, even as broader markets face rotation and volatility. Recent data from Citadel Securities show monthly net notional flows rising again, with the latest figures indicating another surge in strong retail participation. This streak is second only to the 32-month period from April 2020 through November 2022.

⬤ The buying extends far beyond direct stock purchases. Retail traders have been net buyers of ETFs for 158 straight trading sessions selling on only six days since January 2024. Recent months show notional flows firmly back in positive territory, which suggests retail appetite has not cooled despite ongoing macro uncertainty. This steady ETF accumulation reflects a preference for broad market exposure rather than short term tactical bets.

Retail investors have purchased more call than put options for 29 consecutive weeks, the longest such streak on record.

⬤ Options markets tell a similar story. Individual investors have bought more calls than puts for 29 weeks running - an all time record. That signals sustained bullish conviction and ongoing willingness to take directional risk while institutional players remain more cautious. The extended positive readings in net notional data highlight how retail investors actively drive market flows, a sharp contrast to earlier periods when those metrics frequently turned negative.

⬤ This sustained retail demand affects how markets behave. Continuous stock besides ETF inflows create a support level during pullbacks, while aggressive call buying can amplify short term price swings and momentum. Individual investors have evolved from occasional participants into a structural market force, influence liquidity patterns and play a central role in today's equity environment.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi