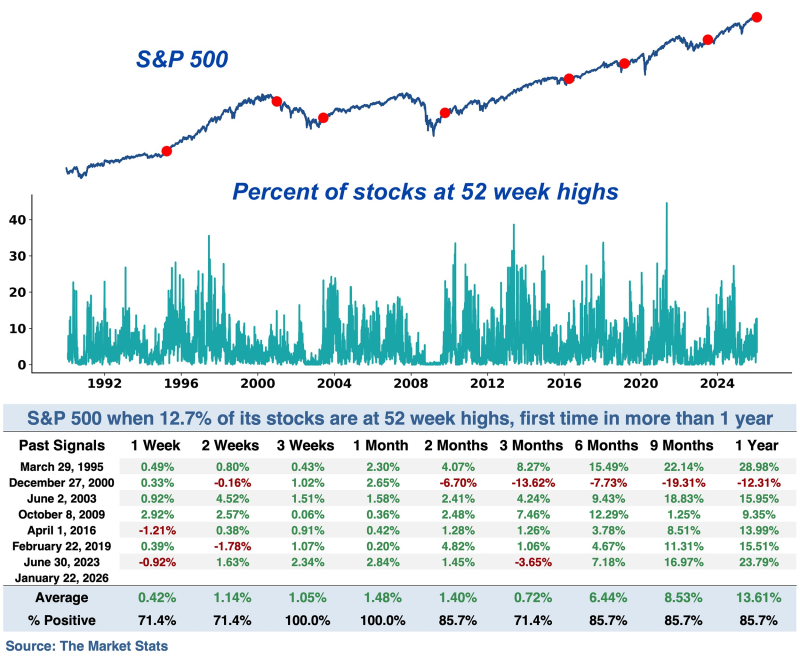

⬤ The S&P 500 is finally getting some broader participation. Right now, 12.7% of companies in the index are trading at new 52-week highs—something we haven't seen in over a year. It's a sign that the rally isn't just being carried by a handful of mega-cap names anymore. More stocks are joining the party, and historically, that's been a good thing for the market's staying power.

⬤ Looking at the chart, you can see how the S&P 500 has moved alongside the percentage of stocks hitting new highs over the decades. Red markers show previous moments when breadth hit similar levels, and in every single case shown, the index was higher three to four weeks later. The lower panel tracks how that percentage has moved over time, and right now we're back at a level that's been pretty reliable in the past.

⬤ The numbers back this up too. Past instances when 12.7% of S&P 500 stocks reached 52-week highs led to positive returns across the board—one week out, one month out, three months out, and beyond. Every recorded signal resulted in higher prices several weeks later, with strong win rates across different timeframes.

⬤ What makes this significant is that it shows the market's strength is spreading out rather than staying concentrated in just tech giants or a few sectors. When more stocks are making new highs, it means the underlying market structure is improving. After going more than a year without seeing this kind of breadth, its return suggests we might be entering a phase where gains become more sustainable and widespread across the index.

Peter Smith

Peter Smith

Peter Smith

Peter Smith