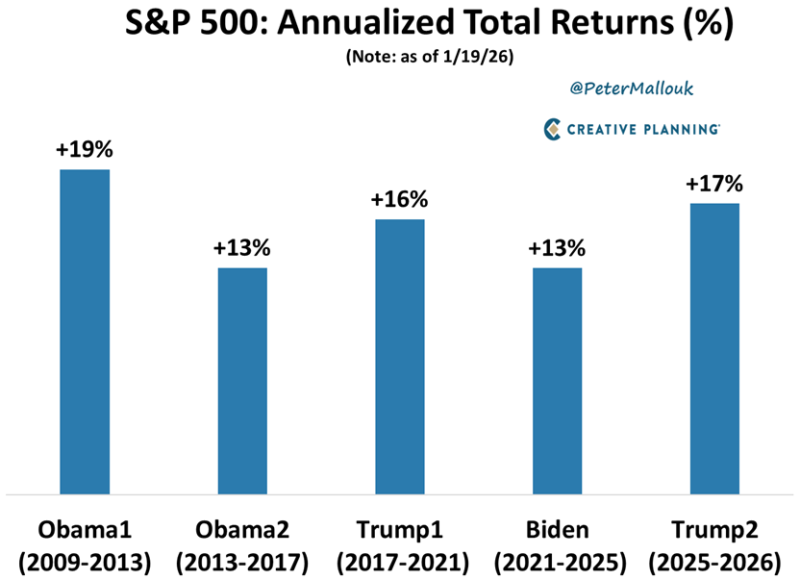

⬤ Here's the thing—the S&P 500 doesn't really care who's sitting in the Oval Office. The numbers tell a pretty clear story. During Obama's first term (2009-2013), the index delivered annualized total returns of about 19%, then around 13% in his second term. Trump's first go-around saw roughly 16% annual returns, while Biden's term averaged about 13% yearly gains.

⬤ Markets just keep climbing, no matter who's calling the shots in Washington. Even in Trump's second term (2025-2026), early data shows annualized returns hovering near 17% as of mid-January 2026. Each administration dealt with completely different economic conditions—different fiscal policies, global crises, Fed decisions, you name it. But the S&P 500 kept delivering.

⬤ What's driving these gains? It's not political cycles—it's corporate earnings, innovation, and economic expansion doing the heavy lifting. Sure, policy matters, but the market's proven it can adapt to whatever's thrown at it. The takeaway here is simple: if you're investing based on election results, you're missing the bigger picture. Long-term fundamentals beat short-term politics every single time.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah