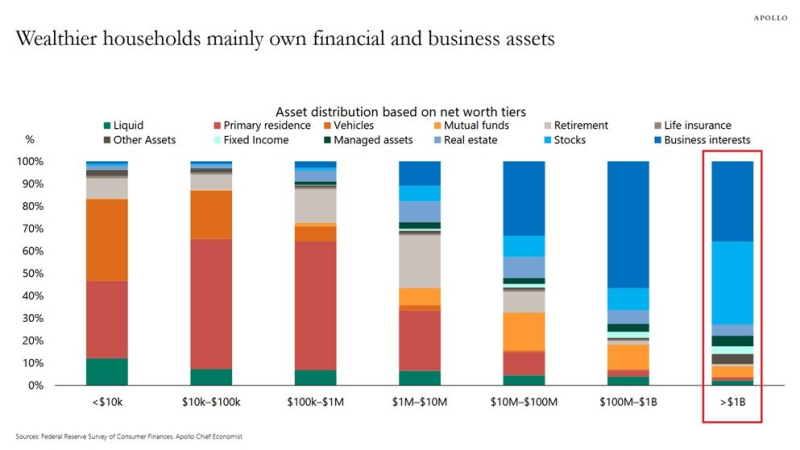

⬤ Recent figures on how Americans store their wealth reveal a plain rule - the larger the fortune, the more of it lives in shares and private companies instead of houses or vehicles. Households above the one-billion-dollar mark place about thirty seven cents of every dollar in listed stocks plus roughly thirty five cents in the value of the firms they control - the ultra wealthy therefore move in step with swings in share prices.

⬤ Between one hundred million and one billion dollars the balance tilts even further toward private enterprise. Business holdings supply around fifty eight percent of total assets, while listed equities add only ten percent. Houses but also cars scarcely appear on the ledger - almost everything those families own is priced each day by the market. At the opposite extreme, people with less than ten thousand dollars in net worth keep thirty six percent of what they own in the roof over their heads and thirty-four percent in the vehicles outside it, with virtually no shares at all.

⬤ Families in the ten-thousand-to-one-hundred-thousand bracket follow the same pattern in starker form - housing absorbs about fifty six percent of their wealth as well as vehicles another ten percent. Anyone below the million dollar threshold owns almost no stock directly - when share prices rise they receive little of the gain.

⬤ Because shareholdings and business stakes cluster at the top, the rewards of a bull market reach only a narrow slice of the population. Equity gains flow mainly to those who already hold the largest portfolios, while everyone else remains anchored to homes or cars that do not grow in value at the same pace. Over the years this split hardens into two distinct financial worlds, each governed by its own rules and starting points.

Peter Smith

Peter Smith

Peter Smith

Peter Smith