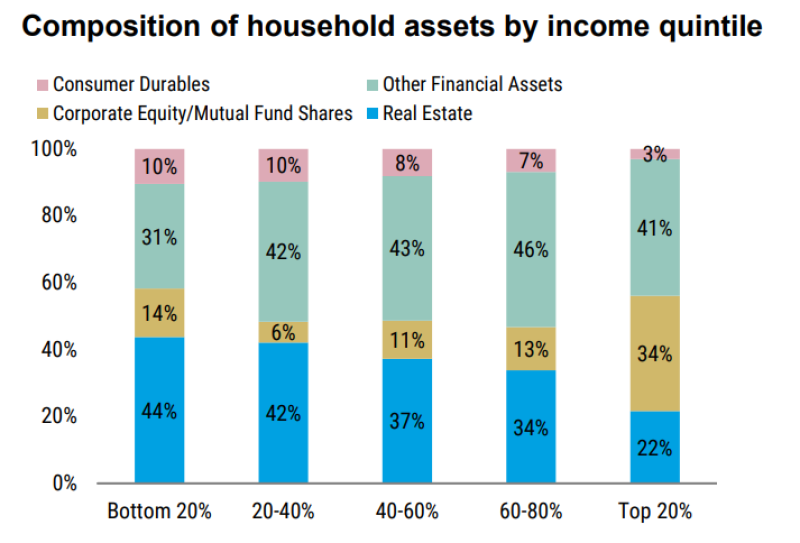

⬤ Fresh numbers from analyst Mike Zaccardi show how U.S. households arrange their wealth by income tier. He splits real estate, financial assets, consumer goods and stock holdings across five income bands. The richest households lean far more on shares to grow their wealth.

⬤ Families in the lowest fifth keep 44 percent of their wealth in homes plus only 14 percent in shares or mutual funds. The pattern shifts as pay rises. The middle fifth holds 37 percent in property and 11 percent in shares. The top fifth reverses the split: 22 percent in property but also 34 percent in company shares or funds. That is where long term growth occurs.

⬤ Bank accounts and similar assets also rise with pay - they move from 31 percent of wealth for the poorest group to 41 percent for the richest. Furniture as well as electronics move the other way falling from 10 percent to 3 percent as pay climbs. The lesson is plain - lower income families own items that gain value slowly, while richer families own assets that grow faster.

⬤ Those splits matter because they decide how families ride out market moves and gain from growth. Shares drive most long term wealth - the gap in what each group owns helps explain why financial strength or spending power drift further apart.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah