- How to become a thriving trader?

- What Helps Famous Day Traders Reach Their Goals?

- 1. Ross Cameron: Is he the Best Forex Day Trader in the world?

- 2. Sasha Evdakov. What is his Net Worth, And How He Made it?

- 3. Rayner Teo. His Secret and the Net Worth

- 4. What Made Steven A. Cohen one of the Most Famous Day Traders?

- 5. Mark Minervini: Net Worth Is Nothing, I Just Want To Be The Best Trader

- 6. George Soros’ Mysterious Strategy

- 7. Bill Lipschutz: Trade Like Crazy or Leave

- Bottom Line

How to become a thriving trader?

You can learn from your mistakes, or you can revert to the history, which knows many successful day traders now. They have not only earned millions of dollars within a short time frame, but also shared their wisdom with audience.

Who are the best day traders in the world, and how did they manage to make millions? This guide unravels a mystery and shows the success stories of daytrading. You will find out more about who the richest traders are, which investing tips they give, and the books they have written.

What Helps Famous Day Traders Reach Their Goals?

Most likely, you already know that there are not a lot of successful day traders – the majority of newcomers leave this field within the first year of trading. The winner-to-loser ratio is pretty high, that’s why many people are so skeptical towards trading. That leads us to the first conclusion: the most successful day traders never give up. The majority give up after losing a certain amount of money while potential winners persevere.

When you read the stories of famous day traders, you will see they have quite a few features in common:

- Self-discipline. Trading requires a lot of attention, devotion, and an extensive period of time;

- Risk control. Top stock traders understand the risk-to-reward ratio, they know when risks are justified, and when they are doomed;

- Courage. The outstanding traders have the guts not to follow the crowd and make their own decisions based on personal analysis;

- Thoughtfulness. It’s important to see and understand the market tendencies, and how they are formed;

- No emotions. Panic-selling is only one of downsides that emotional traders are faced with. They can get upset because of every little thing like unprofitable order or market fluctuations. Stock trading is not a place for sentiments – you have to stay cold-minded;

- Patience. Since the stock market is not easily predictable, it may seem there are no lucky entrance points. Top day traders wait for a perfect moment, even if it takes hours, days, or weeks;

- Dedication. Trading should be your hobby, which means you are willing to invest your time and are ready to learn. Don’t limit yourself by reading books – develop your skills by learning strategies, watching YouTube videos and researching tutorials.

Thinking that day trading is a purely passive income is a big mistake! Practice shows that famous stock brokers spend years on learning the basics of trading, and their education is lifelong. Stock market is too unstable and ever-changing, so you won’t go long using your old knowledge only.

1. Ross Cameron: Is he the Best Forex Day Trader in the world?

Who is the richest day trader today? Probably, Ross Cameron. He was born and raised in Vermont, the USA. He graduated from Vermont College with a bachelor of arts. Even at school, he was fond of architecture and professionally mastered the production of drawing documentation in AutoCAD. In the mid-2000s, Ross lived in Manhattan and worked for an architecture and design firm. Seeing that in the late 2000s, his investments lost value, Ross thought that he could achieve better results if he actively managed his portfolio. He returned to Vermont and began day trading in stocks under $20 with low capitalization.

In 2012, Ross founded the Day Trade Warrior resource - where traders can learn and draw ideas. He wanted to create a community in which traders would be surrounded by other professionals. In 2014, he began conducting training courses with a focus on risk management, stock selection, and maximum entry security. Now Ross continues to train and trade himself. In 2016, he reportedly made $222,244.91!

So, what are his recommendations? Ross Cameron shares his thoughts on why now all newcomers become successful traders:

“After several years of trading on the market and working with traders, I realized that there are two main reasons for failure. The first reason is simple - lack of preparation. The second main reason for failure is the trader’s inability to manage risks. The profitability of trade can be obtained as a result of the implementation of a clearly formulated trading strategy.”

2. Sasha Evdakov. What is his Net Worth, And How He Made it?

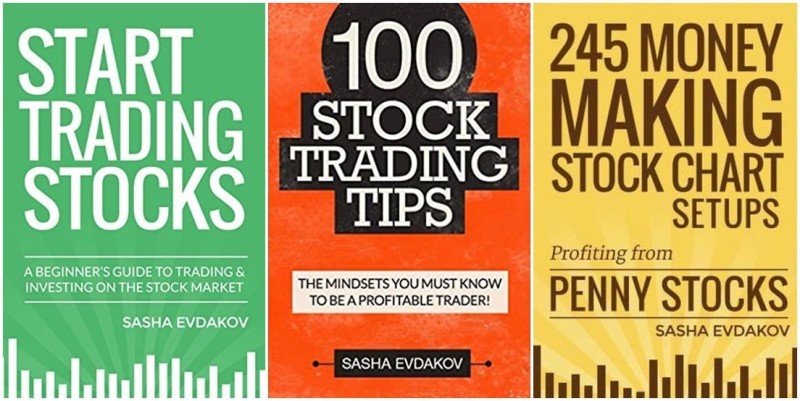

Sasha Evdakov is an author of Tradersfly, and since 2013, he has written ten books, including Start Trading Stocks: A Beginner's Guide to Trading & Investing on the Stock Market, and 100 Stock Trading Tips: The Mindsets You Must Know to Be a Profitable Trader!

While a significant number of his books are focused on stock exchanging, yet huge numbers of the exercises apply to different instruments, likewise. Through Tradersfly, Evdakov has discharged a wide assortment of recordings on YouTube, which talk about an assortment of themes identified with exchanging. Today, he has over 125,000 followers.

As an instructive business person, he is brilliant at educating, and his style is exceptionally straightforward and consistent. Actually, Evdakov says that the 'genuine cash' is in swing exchanging, and his feeling is increasingly outfitted towards it. Although his net worth is not stated in any official source, it’s clear that he’s a big trader with multi-million profits.

All things considered, Evdakov says that he does day exchange from time to time when the market calls for it. He will now and then go through months/day exchanging and afterward return to swing exchanging.

What he implies by this is the point at which the conditions are directly in the market for day exchanging as opposed to swinging exchanging. This features the significance of both being a swing dealer and an informal investor or possibly seeing how the two work.

Sasha Evdakov gives the following recommendations to become a famous person in the stock market:

- Depending on the market circumstance, swing exchanging techniques might be different;

- Some of the best day traders blog and post useful videos – they do not only write books;

- Young stock traders should try swing trading at least for once;

- When you choose between day trading or swing trading, your lifestyle should come into play.

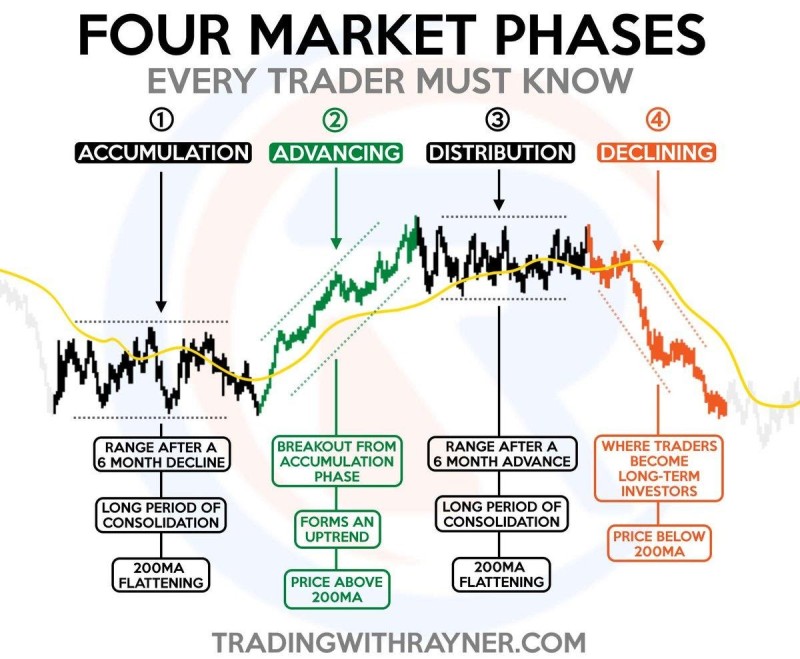

3. Rayner Teo. His Secret and the Net Worth

One of the most famous stock traders, Rayner Teo, runs a YouTube channel with over 174,000 subscribers and TradingwithRayner website that unites over 30,000 traders. He teaches peers how to avoid losing money, what typical mistakes are, and which solutions are applicable in the current market trends.

Here’s how he describes his work:

“At the moment, I am a swing positional trader. I try to grasp individual market movements that occur on a four-hour or daily time frame. A positional trend trader is a trader who follows the trend, and then tries to hold his position until its very end! You know, as the saying goes, the trend is our friend, and you need to follow him until it ends”.

What are his day trading secrets?

Rayner states that trend is a pretty general concept. There can be different trends in the same market in different timeframes. “Personally, I prefer to trade on the daily charts. If the price goes in my direction, I can hold my position for months and even years. And if it turns out that I was mistaken, then I leave the market within a matter of hours or days. That's what my trading strategy looks like in general!” – he says.

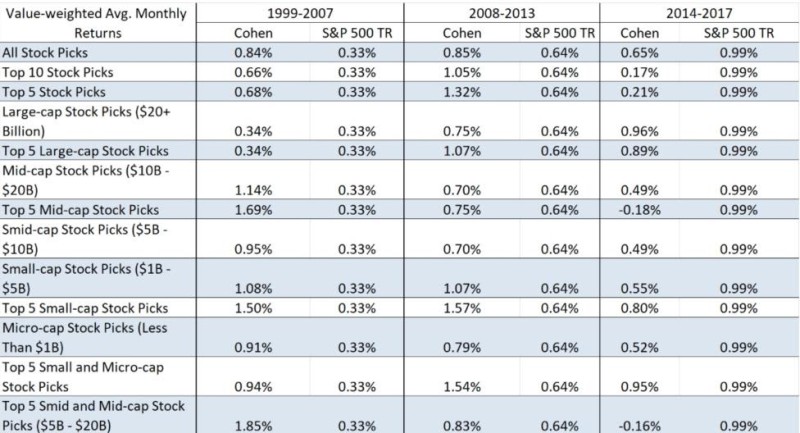

4. What Made Steven A. Cohen one of the Most Famous Day Traders?

Steven Cohen was born in 1957, in Great Neck, New York. In November 2011, he took the 35th place in Forbes’ list of 400 Richest People in America. Currently, his fortune is estimated at $8.3 billion! Why is he one of the most famous traders today?

He is famous for having supernatural abilities to make money under any market conditions. BusinessWeek magazine named Cohen "the most influential trader on Wall Street." He is the founder of SAC Capital Partners.

He studied economics at the University of Pennsylvania, played poker, and became interested in the stock market. In 1978, Cohen got a job at Gruntal, where on the first day, he earned $8,000 for the company. Being a top daytrader, Cohen made about $100,000 a day for the organization. By 1984, he managed a portfolio of $75 million and a group of six traders. On his account, there were transactions that helped Gruntal to cover losses incurred due to the operations of other traders.

In 1992, after leaving Gruntal, Cohen opened the SAC Capital Partners hedge fund, investing $20 million of his own funds there (today, the company manages more than $12 billion). At that time, the hedge fund industry was still relatively small, and the bull market of the 1990s was just warming up.

SAC Capital Partners staff now counts more than 600 people. Nevertheless, Cohen still makes many deals himself. He starts his working day at 8 AM and tracks market charts on his monitors giving ideas to employees. About 15% of the company's profit is obtained from operations performed by him!

5. Mark Minervini: Net Worth Is Nothing, I Just Want To Be The Best Trader

What makes Mark Minervini one of the best traders in the world? In his first year, he made 128% profit and reached 220% in five years – all that with a few thousand dollars in his pocket. Minervini is the author of some useful books, for example, Think and Trade Like a Champion: The Secrets, Rules & Blunt Truths of a Stock Market Wizard.

Minervini says that success in day trading is not about looking for the lowest point – it’s about entering trends instead.

After spending almost ten years in endless analytical work and accumulating a wealth of trading experience, Mark has developed his own clear methodology. In the mid-94, relying on the loyalty of the chosen strategy, whose merits were clearly demonstrated by the steadily growing profits, Minervini combined the existing disparate accounts into one. That account would be the center of the attention of such an impressive report. Up until that point, Minervini worked on several accounts that helped to compare the results of different approaches of investing. Today, five and a half years after opening an account, his profit can be called amazing without exaggeration.

Oddly enough, Minervini managed to significantly increase capital, keeping risk at the lowest level possible: the fall was observed in just one quarter and amounted to only 1%.

In 2000, Minervini became the founder of his own hedge fund - Quantech Fund LP. At the same time, he is the chairman of Quantech Research Group, an analytical company that carries out stock picking in the interests of institutional clients in accordance with the methodology developed by Minervini. During the day, Minervini manages the capital of investors, at night - sits at a computer, studying the characteristics of companies and shares.

Minervini is definitely one of the best stock traders to learn from, and here’s what he recommends:

- Checking trends is more important than buying at the lowest price;

- Work around huge companies;

- When the market situation is complicated, you should lower the risks and profit expectations.

6. George Soros’ Mysterious Strategy

The personality of George Soros has already become a legend among trading fans. This is undoubtedly the most successful top trader. He is known as one of the best traders in history, having a nickname 'the man who bankrupted the Bank of England.' He has one of the most successful day traders' stories: a single transaction of $1,000,000,000.

After graduating from the London School of Economics and Political Science, Soros began his professional career at Quantum Fund, founded in 1969, where he made several lucrative operations. As a result, the company's profit matched the annual income that McDonald's recorded in 1996. However, the most lucrative deals in Soros' career have been with the pound sterling. In 1992, Soros became one the best day trader, making a net profit of $200 million in just a month.

Soros has written several books, including “The Alchemy of Finance,” where he explains his theory of reflexivity that he says helped him succeed in trading.

Yet, the complete truth about the reason of George Soros' financial success is not revealed in his books, because it does not contain any theory about the functioning of the stock market. In fact, his investment philosophy is very different from the theory of reflexivity. The best way to uncover some of his secrets is to read the New Money Monsters' interview with John Train, in which Soros made the following statement:

"My approach works not because I make the right predictions, but because it allows me to correct the wrong predictions."

This is an interesting point to keep in mind if you want to become a top trader. Several Forex traders who have worked with Soros have published some of their investment strategies. One of them is James Marquez, a former chief investment officer:

“Soros’s strategy may seem strange, wrong, and it goes against the rules. He sold cheaply and bought expensively, which can only be understood in connection with his stated mission: to be able to return and recoup another day. "

Soros' other investment director, Alan Raphael, said that Soros never argues, and if he makes a mistake, he admits it and ponders it.

Below are top trading tips that can serve as a basis for developing a strategy in accordance with Soros principles:

- Set aside hypotheses and theories that provide a complete understanding of how markets function. Reaping the benefits depends largely on knowing the exit points and the correct sizing of transactions;

- Define a strategy that makes sense instead of making multiple decisions spontaneously;

- Pay more attention to exit points and order sizes, even if they are tempting;

- It doesn't matter if your strategy is backfiring, you must see failure as a force and limit losses so that you don't wake up bankrupt one day.

7. Bill Lipschutz: Trade Like Crazy or Leave

Lipschutz began trading on the stock market while studying at Cornell University, based in New York. He received an inheritance of $12,000 in shares and invested this money in over 100 shares. These investments helped him find a more profitable way to use the funds received.

During this time, Lipschutz studied financial markets at the Cornell library and began trading. He managed to turn $12,000 into $250,000. However, his success was short-lived, as one perfect mistake cost him almost all the money he earned. Lipschutz reflected on this mistake, which turned out to be a part of valuable experience that helped him in the future.

Just before finishing his studies at Cornell, Bill Lipschutz started trading again and gradually increased his account's size. Then he decided to devote himself entirely to the career of a trader. In 1984, he joined Salomon Brothers and joined the newly formed Forex division. A year later, he made the bank a profit of $300 million.

In 1990, Lipschutz became president of the North Tower Group, a subsidiary of Merrill Lynch. Then, He founded Rowayton Capital Management, which morphed into Hathersage Capital Management in 1995. This fund specializes in trading the currencies of the Big Ten (G10) countries and is still active at the time of writing.

Bill has an unusual motto: Trade like crazy or stay the same. Bill gets enormous pleasure from making money at an insane speed. Yet, it all comes with hard work. A trader, as you know, can watch all the markets simultaneously with a monitor mounted next to his bed so that he could analyze everything around the clock. After all, to make $300 million in just one year, a person needs to work really hard.

Bill Lipschutz has created an effective trading and risk management strategy based on in-depth analysis. Its main principles are as following:

- Time is the cause of risk. Professional players are able to keep an eye on several currency pair trading operations;

- You don't have to come rich to Forex. Every trader learns from his mistakes, and Bill Lipschutz is no exception. Once he lost 250,000 borrowed in 5 days, but that did not stop him;

- Be obsessed with deals. Bill Lipschutz believes that most traders fail to operate profitably in the foreign exchange market, not because they lack the ability, skills, or experience, but because they lack a passion for trading. Money motivation is not correct; making a profit or loss is a ‘side effect of gambling’ on the currency exchange;

- Feel the pain of loss. Every trader has periods when he only bears losses, but the main thing is not to back down. At such moments, a trader begins to treat money more carefully, to calculate and analyze actions;

- Divide the capital. The golden rule of an eminent trader is to never concentrate wealth in one transaction. Following this rule reduces the risks of burnout to the lowest possible level.

- Do not leave a position open with incomprehensible market movements. The position should be increased when it is possible with a high degree of probability to predict the dynamics of economic indicators and price behavior;

- Get it done on time. The principle of any business activity - the more you work, the more your profit. But when trading on the foreign exchange market, the situation is quite the opposite. You can't make an open position more profitable by making an effort. The trader must invest in the preparation process - the study of information for analysis.

Bottom Line

So, what makes the stock traders the best? They are devoted and obsessed with what they do and never give up. The stories of these overwhelmingly successful stock traders prove that there’s no victory without a loss (or many losses), but mistakes facilitate growth.

Can you repeat their achievements? Everything is possible with due dedication. There’s no need to have millions of dollars in your bank account. Start with a demo account, research the market, and read The Tradable blog to keep tabs on what’s happening in the financial area. Some content of this article was prepared in collaboration with a regulated fx-broker Tickmill (start with a demo account).

If you're new to trading and looking for a broker, it can be overwhelming to navigate the many options available. To help narrow down your choices, it's important to compare the main features of different brokers. This includes factors such as trading fees, minimum deposit requirements, trading platforms, customer service, and regulatory compliance. By comparing these features, you can get a better sense of which brokers align with your needs and preferences. In addition, it's always a good idea to read reviews and check the broker's reputation before making a decision.

Peter Smith

Peter Smith

Peter Smith

Peter Smith