Today, our trading hero is John Paulson. This man is often called the legend of the mortgage crisis or the new star of the modern financial market. How did he become rich, and what is John Paulson's net worth? It’s time to reveal his secrets and investing tips.

About John Paulson

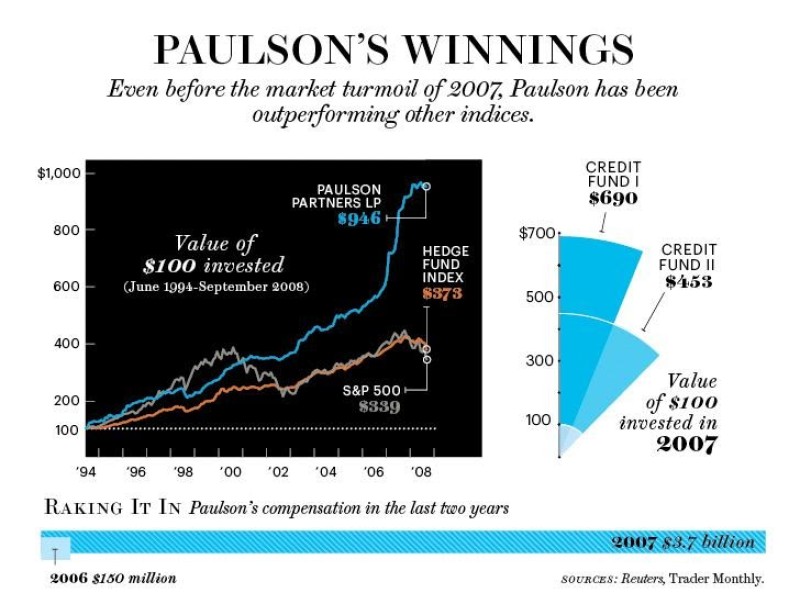

This American investor is well-known for his Paulson & Co fund that managed to earn $ 3.7 billion on the collapsing American market, leaving George Soros with the Quantum Endowment Fund ($ 2.9 billion) and a former mathematician, James Simons, with his Renaissance Technologies Corp. fund far behind ($ 2.8 billion).

This truly fantastic result earned Paulson the top spot in management rankings since 2002. Many experts admit that Paulson's result is the most impressive achievement in money-making for managers in the recent history of the financial world.

Paulson's success is especially surprising when compared to the results of his colleagues. According to Alpha, the top 25 hedge funds in the world, on average, managed to earn only $ 892 million per year - that is, four times less than Paulson & Co. earned. In 2007, only five managers were able to reach the $ 1 billion threshold.

How It All Started

The American financial legend is a New York University graduate who until recently worked at Bear Stearns, which went bankrupt. He received an MBA and worked in the acquisition/merger department.

Like most of today's financial giants, John Paulson started his investing journey from scratch. He took a job at Paulson & Co, a small investment firm with no more than two million dollars at its disposal.

At first, no one noticed this company, except for a narrow circle of experts. Paulson's total funds were barely reaching $ 500 million by 2002. It should be noted that the long-term lack of popularity and attention was only beneficial to the company.

At the beginning of 2007, there was a strange breakthrough: the number of employees at Paulson & Co. increased to almost fifty, and the volume of funds entrusted to Paulson grew thousands times!

Oddly enough, overnight, several wealthy investors, unknown to public till this day, suddenly decided to entrust $28 billion to the Paulson funds. What are the reasons for the overwhelming success? How did he manage to close numerous contracts with some influential insurance companies, banks, and pension funds?

The Role of North American Mortgage Bubble

Most modern analysts share a similar opinion about Mr. John Paulson being the first to predict the imminent and very painful collapse of the American mortgage pyramid. According to Wall Street magazine, events developed as follows:

- Paulson began to express fears about a possible collapse in the American economy back in 2005. During this period, he paid special attention to selling (short) corporate bonds of various companies, first of all trying to get rid of automobile bonds, hoping that the price of these securities would greatly decrease soon, and he would buy them back.

- However, luck at that moment turned away from John, as the markets grew rapidly and the fund suffered colossal losses.

- Realizing the likelihood of a collapse, the millionaire instructs analysts to find a sector in the country's economy where the "bubble" is inflating. In 2005, Paulson asked analysts "Where is the bubble we can short?"

- After conducting market research, analysts suggested that the only correct answer was the sector of substandard US mortgages.

- Paulson starts shorting mortgage papers after establishing the Paulson Credit Opportunities Fund with $150 mln capital.

Back then, the idea of a collapse in the US mortgage market seemed ridiculous to the vast majority of experts. Large investment companies and banks such as Merril Lynch and Citigroup made huge profits precisely on mortgage private equity.

However, time showed that Paulson was right. When the crisis hit the US mortgage market in 2007 and house prices plummeted, it was the weird bearish tactics that made Paulson & Co. so successful and the biggest investment bank (including Paulson's former employer, Bear Stearns) lost their billions.

The big game began on February 7, 2007: New Century Financial Corp., one of the largest US mortgage companies, reported large losses. The ABX index (which was 100 in July 2006), collapsed to 60, and Paulson's new fund earned more than 60% of the profit in February alone. When the index fell to 20, the fund's profits increased further.

There’s one question that still remains unanswered. Who believed in John Paulson and invested in his fund in February 2007? This was a game against the market, and it was not Paulson alone who made stakes on the collapse.

Interesting fact: Prior to the burst of the ‘bubble’, Paulson donated part of his profit to charity - to the very borrowers who were unable to pay the mortgage. In October, he donated a total of $15 million to a nonprofit “watchdog” called the Center for Responsible Lending (CRL), a fund helping families facing foreclosure and home losses.

It’s Not All Gold That Shines…

Since his biggest win, Paulson has gone from one failing trading deal to the next, cutting his 2007 profit, which is still one of the largest hedge funds in history. Paulson wanted another big deal but was too optimistic about the US economic recovery and too bearish about the European debt crisis.

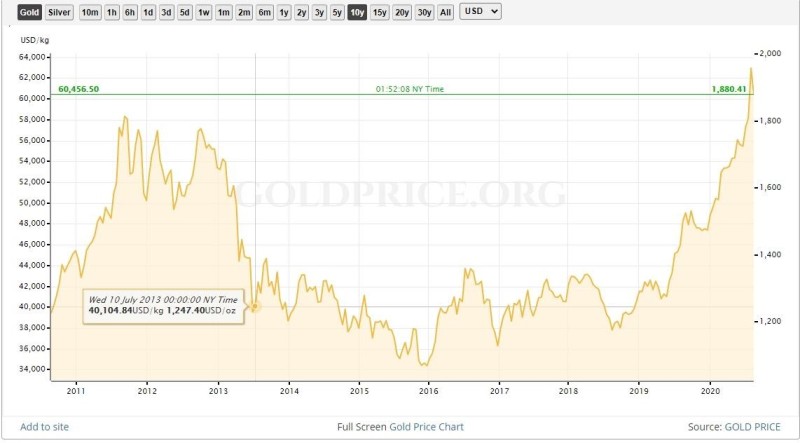

He predicted that gold would strengthen its positions as investors sought a hedge against inflation. It brought him large profits in 2010, but after that, the bear market followed in 2011-2014. The total loss of client funds at Paulson & Co since 2011 was $ 9.4 billion.

Anyway, Paulson found ways to cover his losses. He acts as a true speculator and makes wise investments, for instance:

- From 2007 to 2009, Citigroup shares fell 10 times in price. Paulson opened long positions when the trend was right at the bottom with a share price of $4. In the second half of 2009, the uptrend followed and Citigroup shares became way more expensive.

- In 2013, Paulson’s hedge funds acquired the options of Alpha Bank during the Greece crisis. In 2013-2014, their price skyrocketed.

- In 2014, G. Soros, J. Paulson, and L. Cooperman acquired Caesars Entertainment interest in shares, which also was a great investment in the long run.

Trading Wisdom from John Paulson

Before making a huge profit, John Paulson leveraged a conservative approach called ‘merger arbitrage’. He bought the shares of companies with takeover targets below the acquisition price and waited for a boost. Sometimes, this strategy works but there is always a risk, and winners in this sphere are scarce. Paulson’s talent to dig such brilliants was the decisive aspect.

Today, John Paulson’s strategy is to observe equity markets and find credit default swaps. The investments start paying off when the credit security fails in value. He proved that diversification is important not only for investment options but for strategies, too. He combined conservative arbitrage strategies with clearly speculative ideas while dividing his investments – that worked out pretty well.

So, what’s the lesson to be learned? John Paulson says:

“Many investors make the mistake of buying highs and selling lows while the winning strategy is the opposite one.”

Some investors and traders tend to enter the market at the top because it seems to be looking bullish in long term. However, when the market has already moved up sufficiently, the reverse trend occurs, and it gets ready to make a correction.

For selling, the opposite is true: when the market has been falling for a long time, you should not sell because you may end up selling at the very bottom. You should wait for a price pullback to a resistance area or range of values, and then watch for a sell signal to retrace the trend after the pullback.

Paulson’s Famous Quotes

Here are some of John Paulson’s quotes that might help you understand the nuts and bolts of successful trading:

- “Investors that do the best, and have done the best, are those that stay and compound at above-average rates over the long term.”

- “No one's strategy is correct all the time.”

- “I think buying a home is the best investment that any individual can make.”

- “Our goal is not to outperform all the time – that’s not possible. We want to outperform over time.”

- “Stock market goes up or down, and you can’t adjust your portfolio based on the whims of the market, so you have to have a strategy in a position and stay true to that strategy and not pay attention to noise that could surround any particular investment.”

Thus, if you want to reap profit long-term, you should keep tabs on the market and adjust your strategy according to its every move. Unless you are a day trader, you should focus not on daily or monthly profits – this line of conduct isn’t always fruitful.

So, What is John Paulson's Net Worth?

According to Forbes, John Paulson's net worth is $4.2 bln. In 2007, he managed to make $15 bln for his funds and $5 bln for himself. At their peak, his hedge funds made $36 bln, yet in 2018, this number dropped to $6 bln.

Paulson’s current achievements are:

- #4 on the Hedge Fund Managers list of 2014

- #168 on the Forbes’ 400 of 2019

- #255 on the 2019 Forbes’ Billionaires list

Bottom Line

To some extent, John Paulson is an exception to the rule: he manages to make money where others lose it. What is it? A talent? Intuition? Neither. Paulson’s success is built on his ability to track the market trends and foresee the future even in the most unpredictable periods. He has an eye for shares with huge potential and knows well which companies have a chance to hit it even after a double bottom.

Peter Smith

Peter Smith

Peter Smith

Peter Smith