Gold (XAU) could explode to $5,355/oz if Trump's administration pursues aggressive dollar devaluation, while base case scenarios still target $3,850/oz by Q2 2026. After hitting all-time highs of $3,500 in April, the precious metal has been quietly building energy for its next major breakout, with five critical macro factors now aligning to fuel unprecedented gains.

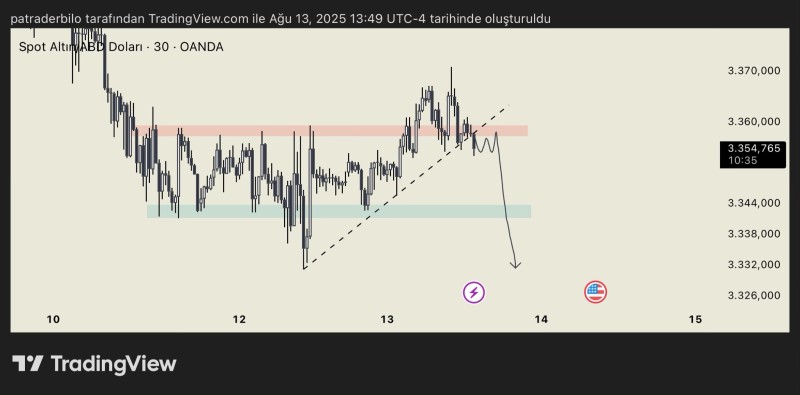

Gold (XAU) Technical Setup: "Loading the Spring" Phase

Gold's been stuck between $3,180 and $3,400 since April's peak, but WisdomTree analysts see this as a classic "loading the spring" pattern – the calm before explosive moves in precious metals.

The lower boundary at $3,180 matches the 76.4% Fibonacci retracement. Even if gold dips temporarily, analysts expect strong buying around $3,024. This sets the stage for a powerful thrust toward $3,850/oz by Q2 2026.

Five Game-Changing Catalysts Driving Gold (XAU) Higher

WisdomTree has identified five macro bombs ready to detonate under gold prices. Trade chaos leads the pack – despite deals with China and the UK, negotiations with Canada, Mexico, and EU remain messy. Completed agreements disappointed markets with hefty tariff increases.

America's debt crisis adds fuel. The "One Big Beautiful Bill Act" added $2.4 trillion to deficits through 2034, pushing debt-to-GDP from 117% to 124%. Including interest, that's over $3 trillion in new debt.

Fed independence is cracking under Trump's attacks on Jerome Powell. This echoes the disastrous 1978-79 period when institutional weakness created perfect conditions for gold's historic surge.

The "Mar-A-Lago Accord" Scenario Could Send Gold (XAU) to $5,355

Here's where things get wild. WisdomTree's most explosive scenario involves Trump deliberately crushing the dollar through a hypothetical "Mar-A-Lago Accord." Think Plaza Accord 2.0, but more extreme.

The original Plaza Accord tanked the dollar 48% from 1985-87. WisdomTree models a 23% drop over one year, but effects would be devastating for dollar holders and incredible for gold. Inflation would explode while bond yields swing wildly as debt credibility crumbles.

Under this scenario, their $5,355/oz target would be conservative, given gold's role as the ultimate currency hedge during dollar chaos.

Their bull scenario assumes tariff shocks force Fed rate cuts, crushing the dollar. Gold could hit $4,475/oz by Q2. Even the bear case – inflation at 2%, yields at 6% – only drops gold to $2,700.

Geopolitical tensions add more fuel. Iran ditched nuclear cooperation after strikes, while Trump's failed Ukraine peace promise backfired. These maintain the fear premium keeping gold bid.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah