Despite gasoline prices tumbling 9.5% and energy commodities falling 9% year-over-year, America's inflation problem isn't going away. The Consumer Price Index sits at 2.7%, refusing to budge toward the Federal Reserve's comfort zone of 2%.

Deficit Spending Fuels Price Pressure

What's keeping inflation sticky? Economists point fingers at massive federal deficit spending that's been pumping money into an already overheated economy. This fiscal firewall means even dramatic energy price drops can't cool things down enough to matter.

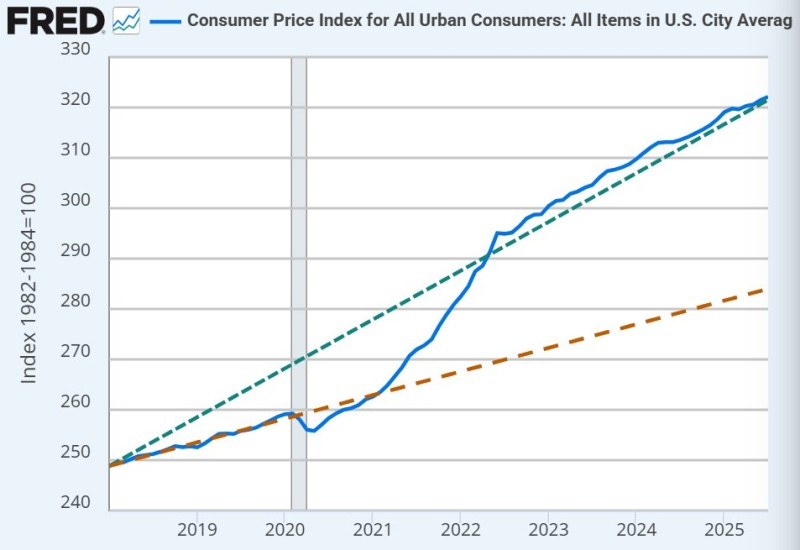

The numbers tell a sobering story: prices today are running over 13% higher than they would've been without the last five years of deficit-fueled spending sprees. That's real money coming out of American wallets every month.

Fed Faces Tough Choices Ahead

The Federal Reserve's own data shows the CPI (blue line) stubbornly tracking above its long-term projection (dotted line). After the wild price surge of 2021-2023, we're stuck on a permanently higher plateau.

This puts Fed policymakers in a bind. Political pressure is mounting for rate cuts, but many economists warn that without serious fiscal discipline from Congress, monetary policy alone won't restore price stability. The central bank might have to keep rates higher for longer than anyone wants to admit.

Usman Salis

Usman Salis

Usman Salis

Usman Salis