NIO's stock price is dancing around a make-or-break moment that's got traders on the edge of their seats. The Chinese electric vehicle maker is testing waters just below the $5 mark, and frankly, this could go either way. What happens next might determine whether we see a genuine recovery or another painful leg down for long-suffering shareholders.

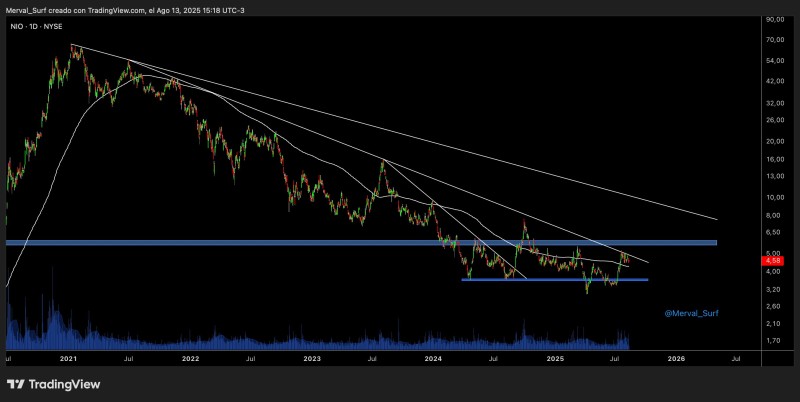

The technical setup here is pretty straightforward, but that doesn't make it any less nerve-wracking. A chart from @Merval_Surf shows exactly what's at stake – NIO is basically caught in no man's land between solid support and stubborn resistance that's been keeping bulls at bay.

NIO Price Finds Its Footing Above Key Support

Right now, NIO's trading at $4.58, and here's the thing – it's actually holding above its 200-day moving average, which is no small feat given how brutal this year has been. That moving average has turned into something of a lifeline, catching the stock every time it threatens to really crater.

But let's be honest about what we're seeing here. While the support is holding, NIO is still stuck under that descending trendline like a ceiling it just can't break through. Every time buyers try to push past $5, sellers come out of the woodwork to smack it back down. It's been this frustrating back-and-forth that's driving everyone crazy.

The 200-day moving average isn't just some random line on a chart – it's become the battleground where bulls are making their last stand. Lose that, and we could be looking at a test of the $4.00-$4.20 range pretty quickly.

$5 Resistance Proves Stubborn as Ever

Here's where things get interesting. That $5 level isn't just psychological – it's backed up by some serious technical muscle. The chart shows this blue resistance zone that's been absolutely bulletproof, and it's right where that descending trendline meets historical price action.

What's wild is how many times NIO has tried to crack this nut and failed. Each rejection has been met with selling pressure that sends it right back down toward support. It's like watching someone try to break down a door – eventually, either the door gives way or the person gets tired and walks away.

If NIO finally manages to punch through $5 with conviction, the next stop could be around $6.50. That might not sound like much, but we're talking about a potential 40% move from current levels. On the flip side, failure here could mean revisiting those lows that nobody wants to see again.

The volume story will be crucial if and when this breakout attempt happens. Without solid buying pressure backing any move above $5, it's just another fake-out waiting to happen. Smart money will be watching for that confirmation before jumping in with both feet.

Peter Smith

Peter Smith

Peter Smith

Peter Smith