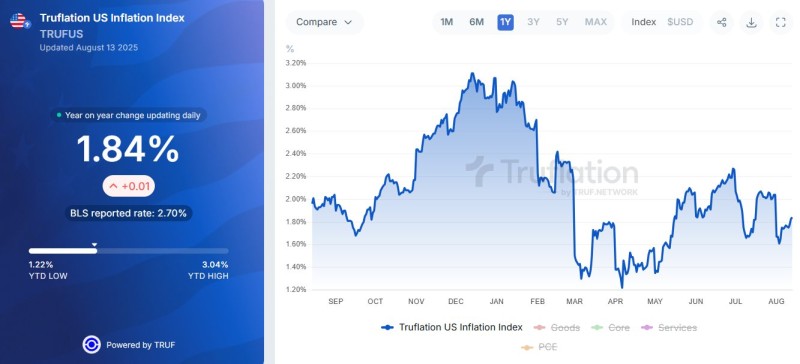

The latest Truflation numbers tell a story the Fed can't ignore much longer. At 1.84% year-over-year as of August 13, US inflation sits comfortably below the Fed's target - and miles away from the Bureau of Labor Statistics' higher 2.70% reading. With just a tiny daily bump of +0.01%, the data shows price pressures aren't going anywhere fast.

What's really catching attention is how far inflation has traveled this year. From a concerning high of 3.04% to a rock-bottom 1.22%, we're now sitting much closer to that floor than the ceiling. The trend line doesn't lie - prices have been cooling off since early 2025, and they're staying cool.

Markets Lose Patience: "The Fed is Late"

The commentary hitting trading floors is getting blunt: "The Fed is late. There's no more time for ego clashes or political decisions. The economy needs interest rate cuts."

That's not just market noise - it's reflecting real frustration among traders and analysts who see the writing on the wall. With inflation this tame, keeping rates elevated looks increasingly like policy inertia rather than prudent caution. Housing markets, consumer credit, and spending patterns are all feeling the squeeze from borrowing costs that no longer match the inflation reality.

What This Means Going Forward

Here's where things get interesting. Truflation's real-time tracking often shows different numbers than government statistics, and many analysts think it's more accurate for capturing what's actually happening in the economy right now. If they're right, the Fed's been fighting yesterday's inflation problem while today's economy needs different medicine.

The pressure's building from multiple directions. Slower growth, persistent rate concerns, and global uncertainty are creating a perfect storm for policy change. Market watchers aren't just hoping for rate cuts anymore - they're expecting them. The question isn't whether the Fed will move, but whether they'll act before economic momentum takes a bigger hit.

Every upcoming Fed meeting now carries extra weight, with investors parsing every word for hints about timing. The message from inflation data couldn't be clearer, but whether policymakers are ready to listen is another story entirely.

Usman Salis

Usman Salis

Usman Salis

Usman Salis