Something remarkable is happening in American trade policy that's catching economists off guard. While tariff revenues are smashing records left and right, the expected inflation surge simply isn't materializing. It's like watching a magic trick where higher trade taxes somehow aren't translating into higher grocery bills—a phenomenon that's rewriting assumptions about how tariffs actually work in today's economy.

Tariff Revenues Hit Record Highs

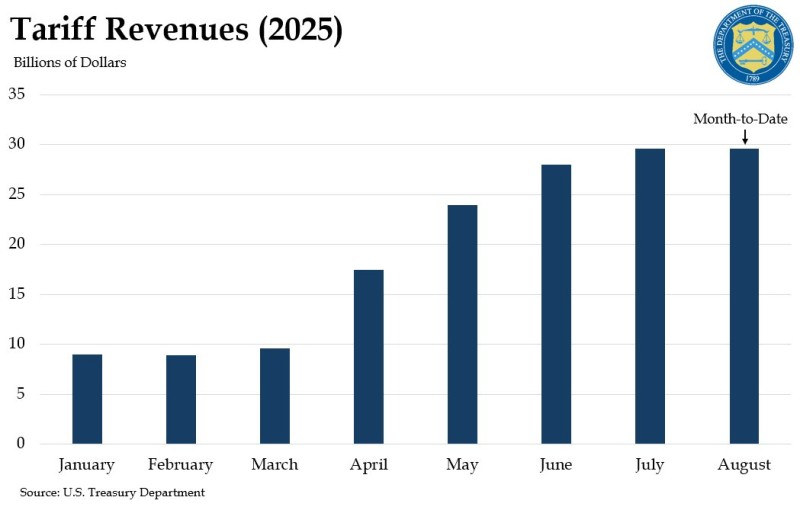

The numbers are staggering. August 2025 has become a watershed moment for U.S. trade revenues, with the Treasury Department reporting tariff collections have blown past $30 billion for the month. The real eye-opener came on August 22, when a single day brought in $23 billion—more than some countries collect in an entire year.

This isn't a gradual climb either. Since April, tariff receipts have been accelerating month after month, creating a revenue stream that's becoming impossible to ignore. What started as incremental increases has turned into a financial avalanche.

Expert Reactions: Trader Highlights the Trend

Trade watchers are scratching their heads over what they're seeing. Trader @SecScottBessent captured the market's bewilderment perfectly, noting how tariff revenues are hitting the stratosphere while consumer prices remain surprisingly tame.

Here's the kicker: economic theory says higher tariffs should mean higher prices for regular folks. Yet household goods have crept up only 0.7% annually since April. Either businesses are absorbing the costs, finding workarounds, or consumers are shifting their buying habits faster than anyone expected.

Inflation Impact Remains Muted

This is where things get really interesting. Despite tariffs pumping billions into government coffers, American families aren't feeling the pinch at the checkout counter. Consumer inflation has stayed remarkably steady, throwing a wrench into the conventional wisdom that trade taxes automatically become a "tax on consumers."

The question everyone's asking: how long can this last? Are we witnessing a fundamental shift in how modern economies handle trade disruptions, or is this just a temporary anomaly before the real impact hits?

Outlook for the U.S. Economy

If this pattern holds, we could be looking at a game-changer for federal finances. Tariffs might actually work as a revenue generator without crushing household budgets—at least for now. The government gets a funding boost while regular Americans keep their purchasing power intact.

But here's the catch: other countries won't sit idle forever. Retaliation is almost inevitable, and supply chains are still adjusting. What looks like a win-win today could become tomorrow's headache if trading partners start hitting back or if businesses run out of ways to absorb the costs.

For now, though, August's numbers tell a fascinating story—record tariff hauls paired with inflation that's barely stirring. It's not what the textbooks predicted, but it's exactly what's happening.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah