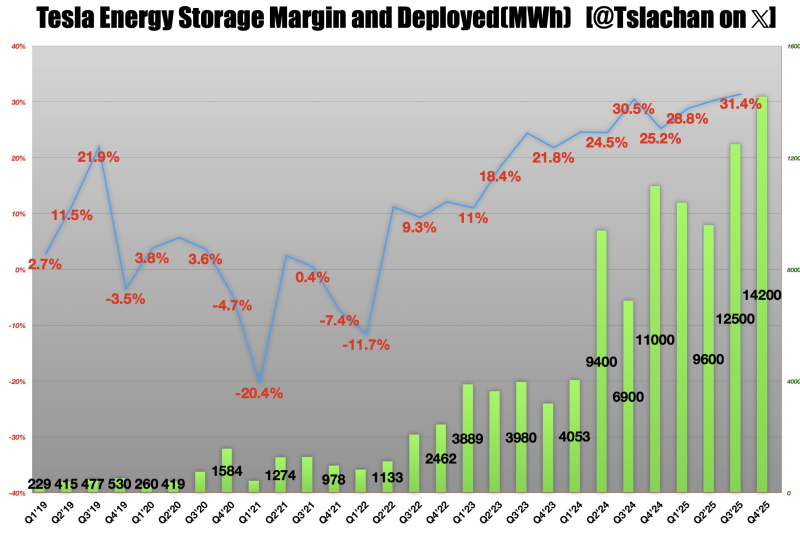

⬤ Tesla (TSLA) is ramping up its energy storage operations while keeping profitability impressively high. Recent figures show quarterly energy storage margins trending upward across recent periods as total storage capacity deployed keeps climbing. The data tracks Tesla's margin performance back to 2019, revealing how the business evolved from modest beginnings into a major segment of the company's operations.

⬤ Energy storage margins have pushed into the 20% range and beyond in recent quarters, hitting levels around 30.5% and 31.4%. That's a dramatic turnaround from earlier struggles—margins once dropped deep into negative territory at -20.4% and -11.7%. The recent trend shows greater stability at higher profit levels as operations scaled up, proving Tesla Energy has become a serious earnings contributor compared to its rocky early days.

⬤ Deployment volumes tell an equally compelling story. Megawatt hour figures have rocketed from early numbers in the hundreds to recent levels in the thousands and tens of thousands. The data shows progression through 3,889 MWh, 3,980 MWh and 4,053 MWh before jumping to projections of 6,900 MWh, 9,400 MWh and 11,000 MWh. Looking ahead, estimates climb toward 12,500 MWh and 14,200 MWh, reflecting expected acceleration in installed storage capacity as demand for large-scale battery storage solutions intensifies.

⬤ The pairing of surging volumes with sustained high margins marks a significant shift in Tesla's business story. The data suggests Tesla Energy is becoming a structurally important revenue and profit engine alongside the automotive business, while highlighting the expanding role of grid-scale battery storage in global energy infrastructure.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah