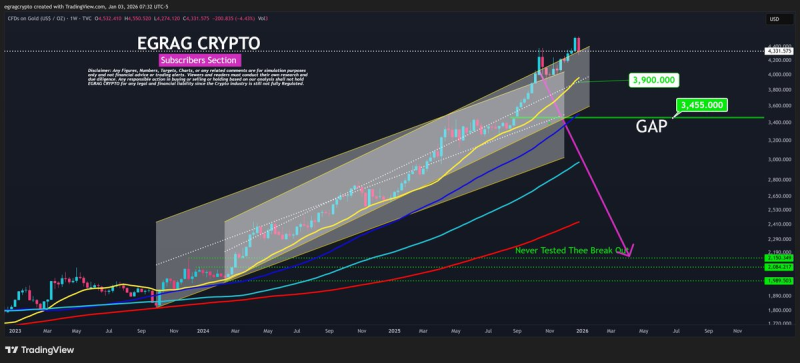

⬤ Gold may be heading into a cooling phase after its recent run-up, based on technical analysis of the metal's weekly chart structure. XAU briefly punched through the top of its rising channel but failed to stick the landing—a classic sign of exhaustion rather than strength. The focus has now shifted to how Gold behaves as it approaches critical support levels below.

⬤ The chart reveals several key zones that could determine the next move. If Gold manages to stabilize after the current pullback, the $3,900 area could offer a relief bounce. But the more likely scenario? A trip down to fill the gap around $3,455. There's also a deeper support level at $2,150, though that would only come into play if the broader macro structure completely falls apart—which isn't the expected outcome right now. The takeaway here is structure over emotion: the market just needs to catch its breath after failing to hold the breakout.

⬤ The most probable path forward involves a cool-off in Gold, a gap fill somewhere between $3,400 and $3,455, and then a fresh look at the trend from there. This isn't a bearish call—it's more of a technical reset within what remains a long-term bullish setup. The weekly chart shows XAU still sitting comfortably above major moving averages, confirming the broader uptrend is intact.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi