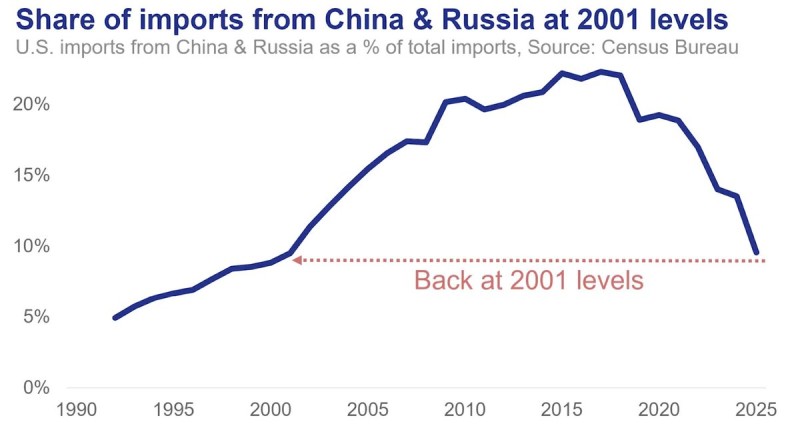

America has dramatically cut its reliance on Chinese and Russian imports, bringing their combined share down to levels not seen since 2001. As analyst @lourenco_vs highlights, this decline has been particularly sharp in the post-Covid era, signaling a decisive break in long-established trade patterns. Recent Census Bureau data reveals that nearly 25 years of trade growth has been completely reversed.

The Numbers Tell the Story

Looking at U.S. imports from China and Russia as a percentage of total imports, the data shows three distinct phases. From the 1990s through 2001, imports climbed steadily from around 5% to just over 10%. The globalization boom then kicked into high gear, with the share surging to peak above 18% by 2018 as China became the world's factory and Russia supplied energy markets. But since 2019, there's been a dramatic reversal, with the combined share crashing back to roughly 10% - essentially where things stood at the millennium.

What's Driving This Massive Shift

Several key factors explain this historic turnaround:

- Trade wars and geopolitical tensions that shattered long-standing supply relationships

- Post-pandemic diversification as companies sought more reliable sourcing outside China

- Energy sanctions that cut off Russian oil and gas imports

- U.S. industrial policy encouraging domestic production and partnerships with allies

- Technology restrictions limiting imports of sensitive goods and materials

The decline has been particularly steep since Covid-19, suggesting the pandemic accelerated changes that were already building due to rising political tensions between these nations.

The Bigger Picture

This isn't just a temporary market correction - it represents a fundamental restructuring of global trade. China now faces reduced access to its largest export market, challenging its manufacturing-focused economic model. Russia finds itself increasingly isolated from Western markets, forcing deeper ties with Asian partners. Meanwhile, America gains supply chain security but potentially faces higher costs as domestic and allied production typically comes with premium pricing.

This dramatic reversal shows how geopolitical priorities are reshaping international commerce. We're entering an era where strategic considerations matter as much as economic efficiency, and both investors and policymakers need to adapt to a world where trade flows follow political alliances rather than just market logic.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah