While economists debate inflation data and Federal Reserve officials consider rate cuts, American families are living a different reality. They're watching their paychecks buy less at the grocery store, seeing rent payments consume bigger chunks of their income, and wondering when relief might come. Recent consumer surveys reveal this growing anxiety, creating a stark contrast with the Fed's more optimistic outlook.

Rising Inflation Expectations

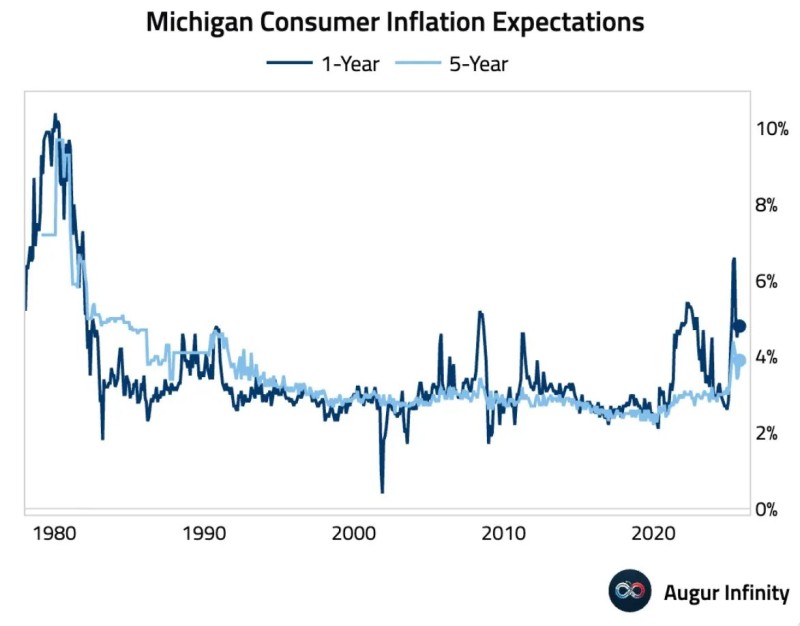

Market analyst Danny Dayan recently highlighted this disconnect on social media, pointing to University of Michigan survey data showing Americans expect inflation to average around 4% over the next five years. Short-term expectations have spiked even higher, sometimes exceeding 6%.

This represents a significant shift from the pre-2020 era, when inflation expectations stayed closer to the Fed's 2% target. While we're nowhere near the double-digit expectations of the early 1980s, the current levels suggest many Americans doubt that price stability will return anytime soon.

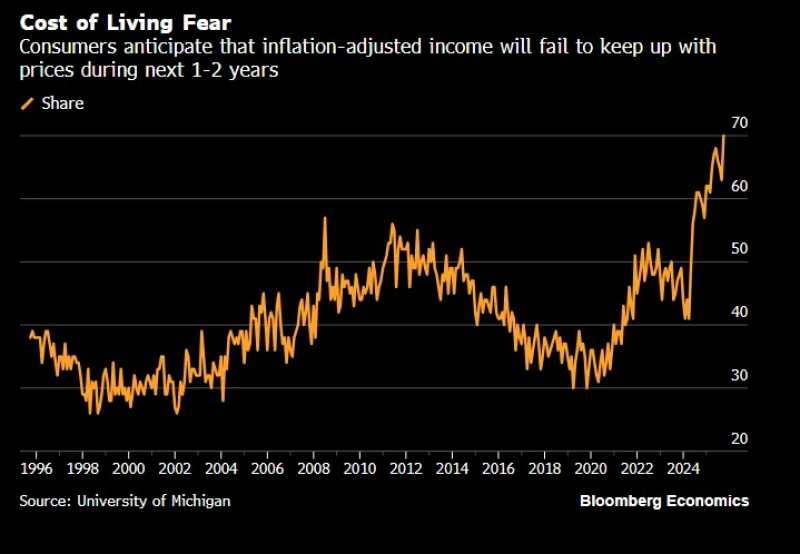

Cost-of-Living Concerns Peak

Bloomberg Economics data paints an even starker picture of household sentiment. Nearly 70% of consumers now believe their income won't keep pace with rising prices over the next couple years — the highest reading in decades.

Even as official inflation numbers have cooled, families continue grappling with stubborn housing costs, elevated grocery bills, and unpredictable energy prices. For most households, inflation isn't an abstract economic concept measured in percentages — it's about whether they can afford the same lifestyle they had last year.

Market Implications

This tension between consumer pessimism and Fed optimism creates several investment considerations:

- Bonds: Rate cuts typically boost bond prices, though persistent inflation fears could keep long-term yields elevated

- Stocks: Lower rates might provide short-term support, but weakening consumer spending could hurt company earnings

- Commodities: Gold and other inflation hedges often perform well when expectations rise and real interest rates fall

The Fed's Different View

Federal Reserve officials see the situation through a different lens. They point to what they call "well-anchored" long-term expectations and appear ready to cut interest rates to support economic growth.

However, some critics worry about easing monetary policy too quickly. If cheaper borrowing costs encourage more spending while supply chains remain strained, it could trigger another round of price increases. As Dayan noted, there's an irony in consumers complaining about inflation while the central bank considers making debt cheaper.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah