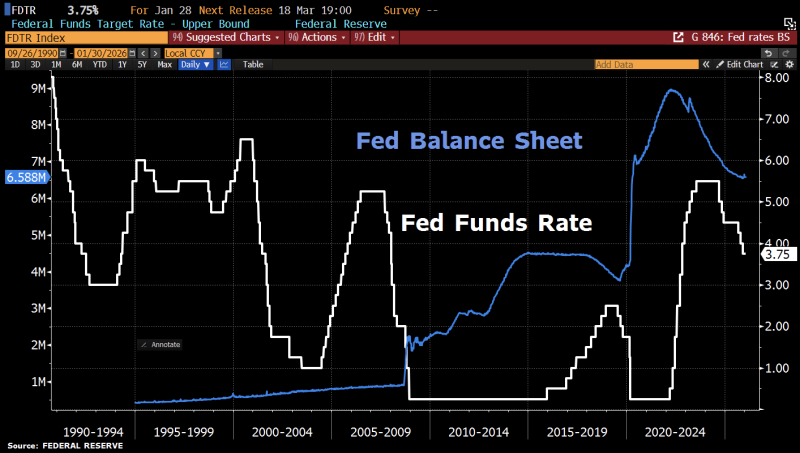

⬤ President Trump has chosen Kevin Warsh to take over as Federal Reserve Chair when Jerome Powell's term wraps up in May. The move is getting plenty of attention from people watching US monetary policy, especially with questions swirling about where interest rates are headed and what happens with the Fed's massive balance sheet. The chart shows how these two policy tools have moved together over the years, giving us some historical perspective as the central bank gets ready for new leadership.

⬤ Warsh isn't new to the Fed. He sat on the Board of Governors from 2006 to 2011, right through the financial crisis. Back then, he was known for pushing higher rates even when the economy was hurting, constantly worried that keeping policy too loose would spark inflation down the road. That made him stand out from his colleagues, who were rushing to drop rates to zero and roll out emergency measures to keep the financial system from collapsing.

⬤ But Warsh's tune has changed since he left the Fed. He's been talking up lower borrowing costs lately, which is a pretty big shift from his earlier inflation-hawk days. "The Fed needs to be more responsive to current economic conditions rather than fighting yesterday's battles," Warsh noted in recent commentary. The chart makes it clear how rate changes have typically lined up with the Fed expanding or shrinking its balance sheet, particularly during crisis responses and the tightening that followed. With rates sitting around 3.75% right now, everyone's wondering if Warsh's evolved thinking will actually shape future calls on rates and how much money flows through the system.

⬤ This appointment matters because whoever runs the Fed has enormous influence over where monetary policy goes. A new face at the top can shift expectations on interest rates, move currency markets, and reshape financial conditions across the board. As the handoff gets closer, traders and investors will be watching closely to see how Warsh's experience and his changing policy views play into the next chapter of US monetary policy and the constant balancing act between keeping inflation in check and keeping the economy growing.

Usman Salis

Usman Salis

Usman Salis

Usman Salis