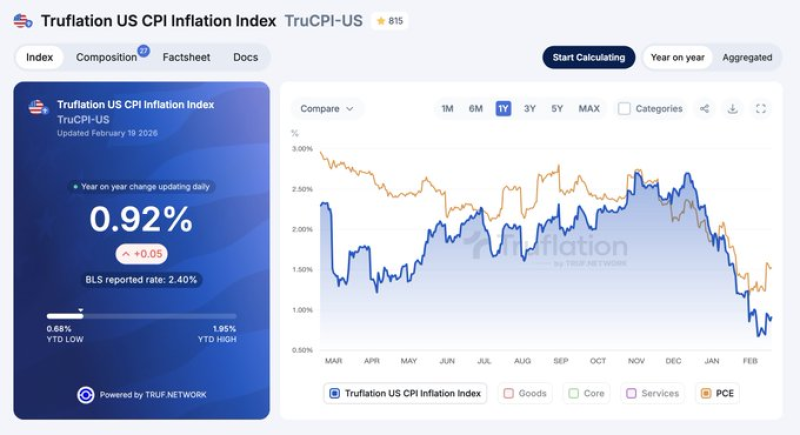

⬤ U.S. inflation estimates from alternative data provider Truflation showed consumer prices rising just 0.92% year over year, significantly lower than the official Bureau of Labor Statistics reading of 2.4% for January. The index compiles millions of real price observations from multiple providers and updates daily, giving traders and analysts a faster snapshot of inflation trends than traditional monthly surveys that often lag several weeks behind actual market conditions.

⬤ The same dataset placed Personal Consumption Expenditures inflation at 1.53%, compared with the latest official reading of 2.8% recorded for November. The next official December PCE report from the Bureau of Economic Analysis is due soon, and markets are waiting to see if it confirms what real-time PCE inflation cooling data has been suggesting for weeks. According to Truflation's methodology, price pressures appear to be cooling across several categories including food, energy, and housing, though delayed government reporting means official figures may take months to catch up with what's happening in stores right now.

The persistent gap between real-time estimates and official statistics shows how measurement timing can significantly affect both market expectations and policy decisions.

⬤ The Federal Reserve relies heavily on the PCE index because it captures broader consumer spending patterns than CPI, including healthcare costs paid by insurance and government programs. This US CPI real-time inflation gap between high-frequency tracking and monthly government reports has become a hot topic among economists and traders who need to make decisions based on current conditions rather than backward-looking data. Recent real-time indicators have repeatedly pointed to softer inflation than what eventually appears in traditional datasets.

⬤ The growing divergence between government statistics and high-frequency tracking has sparked debate about whether inflation measurement methods need updating for the digital age. With the upcoming PCE release just days away, markets are closely watching whether official figures will finally confirm the cooling trend or continue to show Truflation CPI divergence debate that alternative data has been highlighting for months.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi