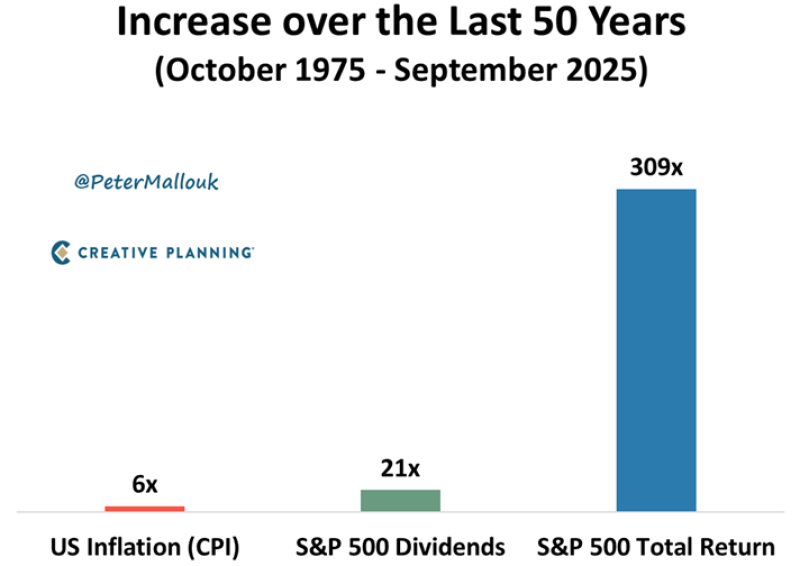

⬤ Recent analysis covering October 1975 to September 2025 reveals that the S&P 500 total return multiplied 309 times, while U.S. inflation (CPI) merely increased sixfold and dividends grew 21-fold. This data shows that equities have consistently beaten inflation and preserved investor purchasing power over time.

⬤ The compounding effect driving these gains is striking. While consumer prices climbed steadily across five decades, dividend growth and reinvested returns generated exponential wealth. This performance demonstrates how U.S. corporations continuously create and distribute shareholder value, especially for those who stay invested through market ups and downs.

⬤ While equities prove resilient against inflation, short-term challenges like rate hikes, recessions, and valuation drops persist. Market swings can shake investor confidence, and future returns aren't guaranteed. Still, half a century of data makes a strong case that holding a diversified stock portfolio long-term is among the most dependable ways to build real wealth.

⬤ The evidence is clear: over extended periods, stocks crush inflation and maintain purchasing power. Despite economic turbulence and price pressures, equity markets have consistently rewarded patient, disciplined investors. For anyone focused on lasting growth, the S&P 500's track record speaks volumes about the value of staying the course.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah