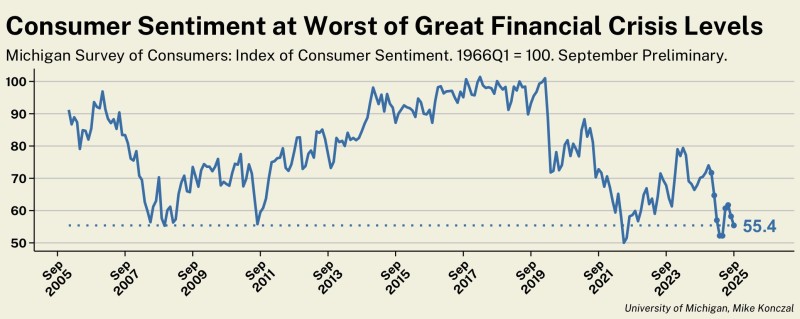

The University of Michigan Consumer Sentiment Index has dropped to a devastating 55.4, marking the lowest reading since the Great Financial Crisis. This dramatic collapse in household confidence reveals deep concerns among American consumers about their economic future. With consumer spending driving nearly 70% of U.S. economic activity, such pessimism could signal rougher times ahead for the entire economy.

Back to 2008 Territory

As Mike Konczal notes, current sentiment levels mirror the darkest days of the 2008-2009 financial crisis, when banks were failing and unemployment was soaring. The only other time we've seen readings this low in recent years was during the summer of 2022, when inflation peaked above 8% and household budgets were under severe strain. The sharp decline throughout 2025 has pushed the index back into the dangerous mid-50s range that historically signals serious economic distress.

What's Driving the Pessimism

- Persistent inflation eating away at purchasing power despite some improvement in headline numbers

- High interest rates making borrowing expensive for homes, cars, and credit cards

- Job market uncertainty as hiring slows and workers worry about layoffs

- Rising costs of essentials like housing, healthcare, and groceries

- Political and economic uncertainty affecting long-term planning

The combination of these factors has created a perfect storm of consumer anxiety, with households feeling squeezed from multiple directions.

The Bigger Picture

The chart data confirms that sentiment has crashed through the critical 60 support level and is now stuck near crisis territory. History shows that when consumer confidence falls this low, it often precedes recessions or significant drops in household spending. Since American consumers are the backbone of economic growth, their pessimism typically becomes a self-fulfilling prophecy as reduced spending leads to business cutbacks and job losses.

This creates a challenging situation for policymakers at the Federal Reserve, who must balance fighting inflation with supporting economic growth. If confidence doesn't recover soon, they may face pressure to cut interest rates to prevent a deeper economic slowdown, even if inflation hasn't fully retreated to their target levels.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah