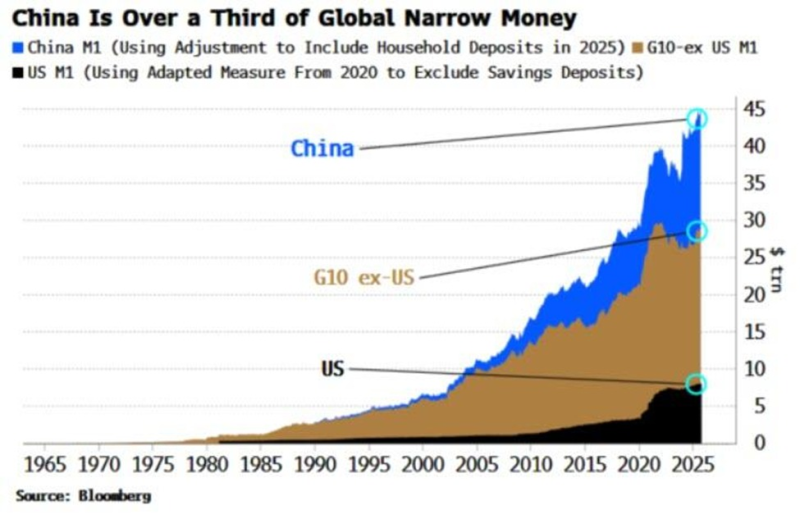

⬤ Global money supply just hit a record $45 trillion, and China's basically running the show. The latest numbers show China now makes up over a third of the world's narrow money, completely reshaping how global liquidity looks today.

⬤ China's M1 money supply climbed to around $16.5 trillion—the highest it's ever been. That's roughly 37% of all global narrow money, making China the biggest M1 producer worldwide. The growth didn't happen overnight either. China's share started picking up steam in the early 2000s and really accelerated recently. Meanwhile, M1 growth across other major economies outside the U.S. looks pretty tame by comparison.

China has been the primary driver of global money supply growth during the latest period, according to market analysts tracking these trends.

⬤ The U.S. is still a major player with its narrow money supply sitting near $8 trillion (about 18% of the global total when you exclude savings deposits from M1). But here's the thing—China's expansion has clearly outpaced America and every other major economy. That gap keeps widening, which tells you a lot about where global liquidity is actually coming from these days.

⬤ Because money supply levels directly shape financial conditions, where capital flows, and what happens across economies. More money in the system affects everything from inflation to currency values to how assets get priced. With China now controlling such a huge chunk of global narrow money, whatever happens in their monetary policy ripples everywhere. As liquidity keeps climbing worldwide, watching how money supply shifts between major economies becomes crucial for understanding where markets and economies are headed.

Peter Smith

Peter Smith

Peter Smith

Peter Smith