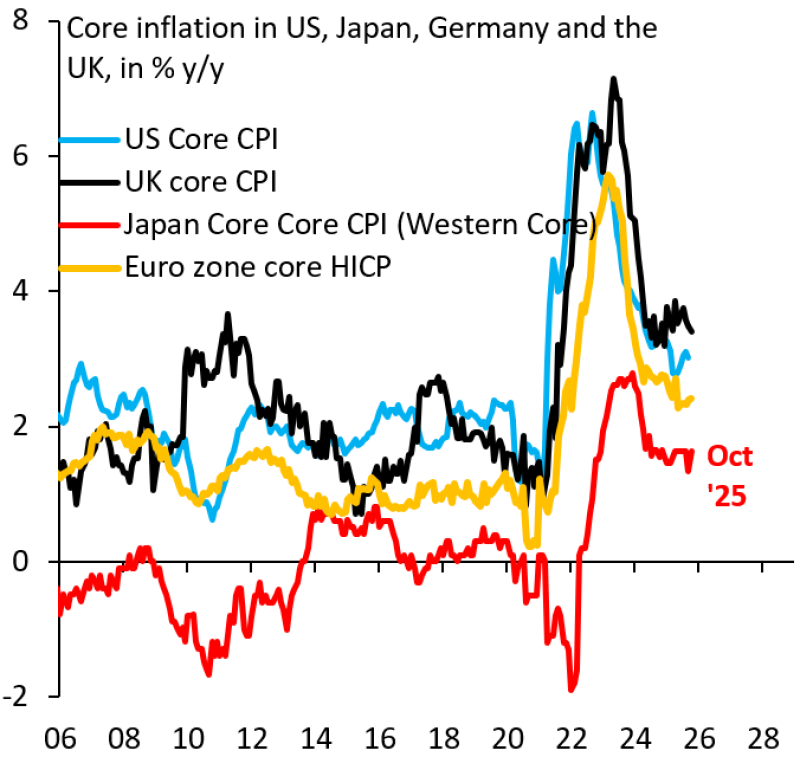

⬤ Core inflation in the largest advanced economies remains higher than before COVID-19. Recent figures show that prices in the United States, the United Kingdom, the Eurozone besides Japan have not returned to the low, steady ranges seen before 2020. Year-over-year core inflation from 2006 through October 2025 places every region at a higher plateau, even after the sharp retreat from the 2022-2023 peaks.

⬤ The figures mark a clear break from past norms. US core CPI now stays near 3 %, well above the 1-2 % range that prevailed in the ten years before the pandemic. The UK records the highest rate, with core inflation close to 4 %. The Eurozone has settled near 3 %, up from its earlier trend around 1 %. Japan has reached about 2 % inflation after decades of near zero prices, a dramatic shift for an economy that long battled deflation.

Those high readings do not match short lived supply shocks - they mirror robust underlying demand in a global economy that keeps running hot.

⬤ The key point is that the rise is not just a legacy of snarled supply chains or surging energy costs. Those strains have faded - yet core inflation refuses to retreat. Global demand remains too firm - price pressure stays above the level central banks regard as acceptable. The pattern points to lasting demand forces rather than temporary disruptions.

⬤ The implications are wide. Inflation that stabilises above pre pandemic levels reshapes interest rate decisions, currency moves and investor expectations across the global economy. Sustained higher inflation guides monetary policy, redirects international capital and reinforces what some analysts label the “debasement trade.” The data deliver a plain message - the post-2020 world economy may have entered a phase in which inflation stays structurally higher than in the 2010s.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi