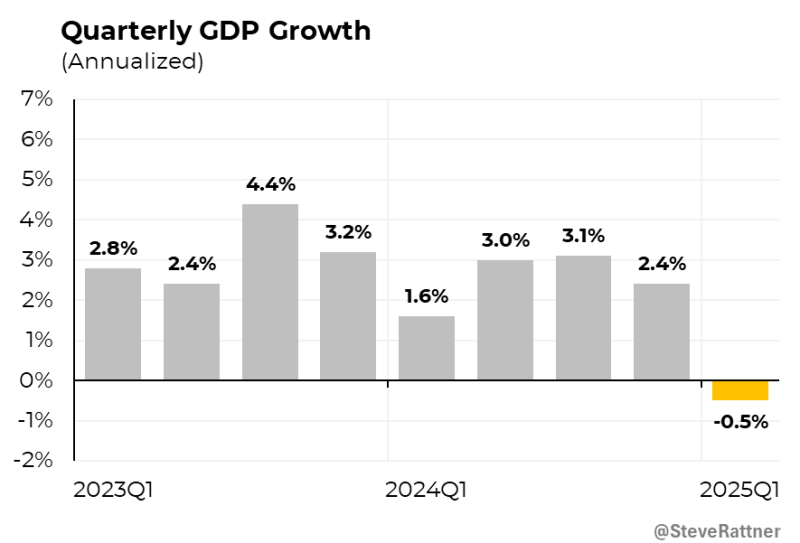

The U.S. economy delivered an unexpected jolt in Q1 2025, as the Bureau of Economic Analysis revised GDP growth to -0.5%, marking the first quarterly contraction since 2022. After several quarters of consistent expansion, including a 2.4% increase in Q4 2024, this negative turn has reignited concerns about the strength of the recovery and the potential for a broader economic slowdown. The drop underscores mounting economic pressures heading into the second half of the year.

U.S. GDP Turns Negative in Early 2025

According to a recent update by Steve Rattner on X (formerly Twitter), U.S. economic output contracted by -0.5% in Q1 2025, marking the first quarterly decline in nearly two years. This follows a relatively stable 2.4% growth in Q4 2024, highlighting an abrupt shift in economic momentum.

The revision casts doubt on the resilience of the U.S. economy, which had shown consistent growth in prior quarters — including a 4.4% surge in Q2 2023 and stable 3%+ expansion through most of 2024. Analysts are now questioning whether this contraction is a temporary blip or the start of a broader economic downturn.

Trend Reversal After Steady Growth

From Q1 2023 to Q4 2024, the U.S. maintained an average quarterly growth of around 2.9%, supported by strong consumer demand and post-COVID recovery trends. However, the sharp drop to negative territory in Q1 2025 signals mounting headwinds such as tighter monetary policy, weakening demand, or geopolitical uncertainties.

While it's too early to confirm a recession, the data suggests a potential shift in the economic cycle. If the trend continues, it could impact corporate earnings, labor markets, and Fed interest rate decisions moving forward.

Conclusion

With Q1 2025 GDP now at -0.5%, the U.S. economy faces renewed scrutiny. Investors, policymakers, and traders alike will be closely monitoring Q2 figures and inflation indicators for confirmation of either recovery — or a prolonged slowdown.

Peter Smith

Peter Smith

Peter Smith

Peter Smith