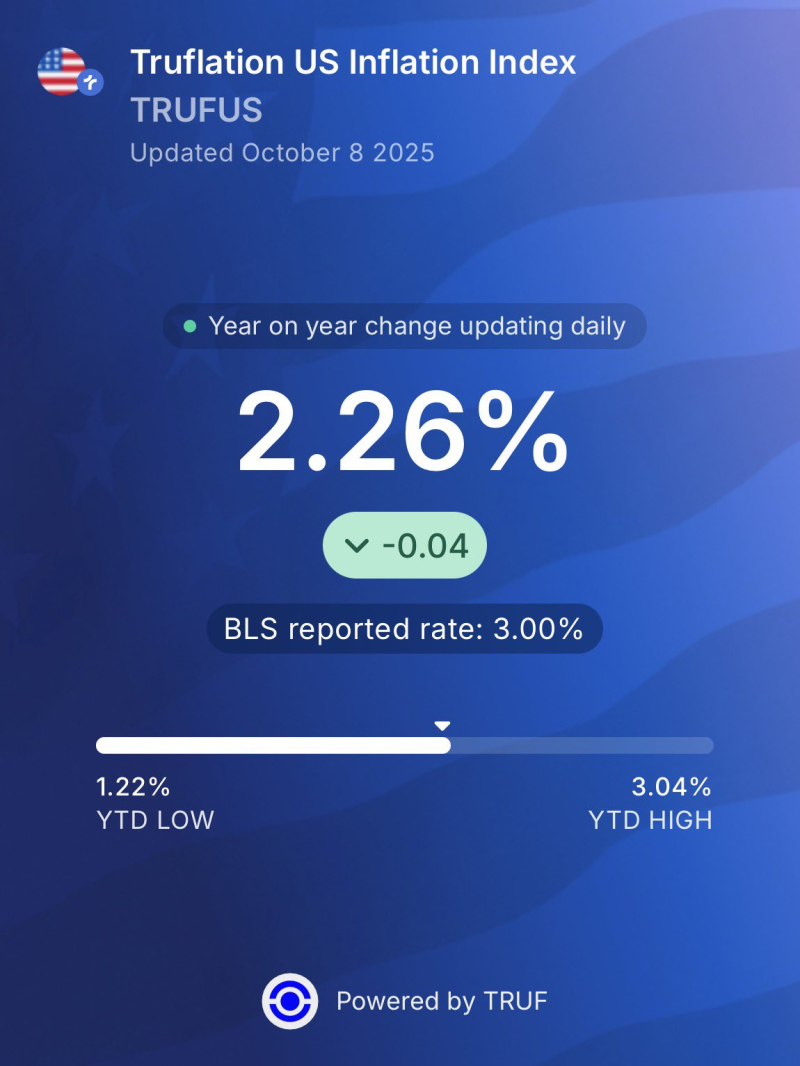

⬤ US inflation keeps falling, and that's got people wondering if the Federal Reserve is about to change course. The Truflation Index now shows inflation at 2.26% year-over-year—well below the official 3.00% figure—and heading toward the low end of 2025 projections. This drop has everyone talking about what the Fed does next, especially since they've started dropping hints about adjusting their approach to market liquidity.

⬤ Some policy watchers think a return to QE might need fiscal tweaks to keep markets steady during the transition. While big monetary shifts often trigger governments to rethink their fiscal strategy to balance liquidity against debt concerns, the exact approach remains unclear. The main risks? Financial market jitters, potential liquidity crunches if QE restarts too fast, and banks scrambling to adapt to rapid rate changes. On the bright side, political headwinds may ease soon, removing at least one source of uncertainty from the equation.

⬤ The timing looks significant. Inflation has slid from a year-to-date peak of 3.04% to much tamer levels, and the Fed's recent comments suggest they're reconsidering their tight-money stance. With QT officially ending December 1st, investors are reading between the lines—many believe these signals point to the Fed preparing to loosen the purse strings again.

⬤ The big question now: is a full policy reversal coming? If the Fed pivots back to QE, it'll reshape everything from borrowing costs to how money flows through different sectors. For now, everyone's watching the inflation numbers and Fed statements, trying to figure out if this monetary U-turn is actually happening.

Peter Smith

Peter Smith

Peter Smith

Peter Smith