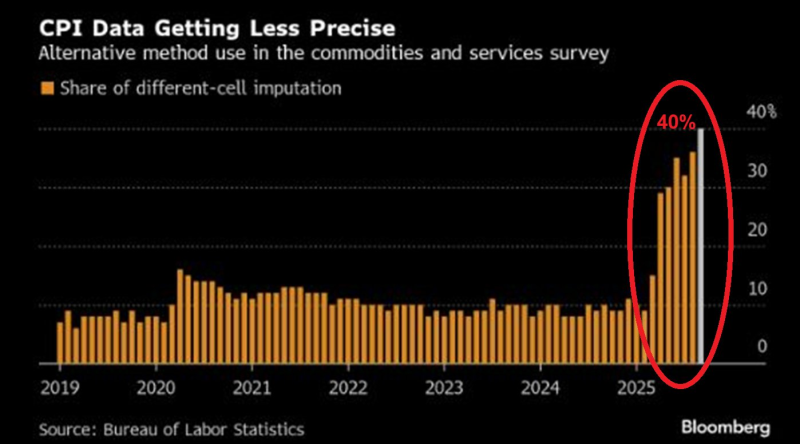

● A recent post by Global Markets Investor has reignited debate over U.S. inflation data quality. According to their analysis, "a record 40% of price quotes in the US CPI inflation are made up, based on assumptions, not real prices." Bloomberg data backs this up, showing that the Bureau of Labor Statistics (BLS) is now using "different-cell imputations" at unprecedented levels.

● Normally, the BLS collects about 90,000 actual prices monthly across 200 product categories. But when prices can't be gathered—because items are out of stock or unavailable—the agency fills gaps with statistical estimates. The sharp rise in these estimates is troubling, especially when the Federal Reserve relies on CPI data to make critical monetary policy decisions.

● This timing couldn't be worse. Governments are rolling out new tax proposals including higher consumption taxes, digital service levies, and energy surcharges. If inflation readings are off, these policies could be built on faulty assumptions. Smaller businesses might face unexpected pressure, and tax revenues could miss targets.

● When half your inflation data comes from models instead of reality, you risk making bad policy calls. If CPI doesn't reflect what people actually pay, everything from interest rates to tax brackets gets thrown off.

● The stakes are high. Inaccurate inflation data doesn't just affect markets—it shapes how much families pay in taxes and whether businesses can stay afloat. As imputation rates hit record highs, the question becomes harder to ignore: can we still trust the numbers driving trillion-dollar decisions?

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi