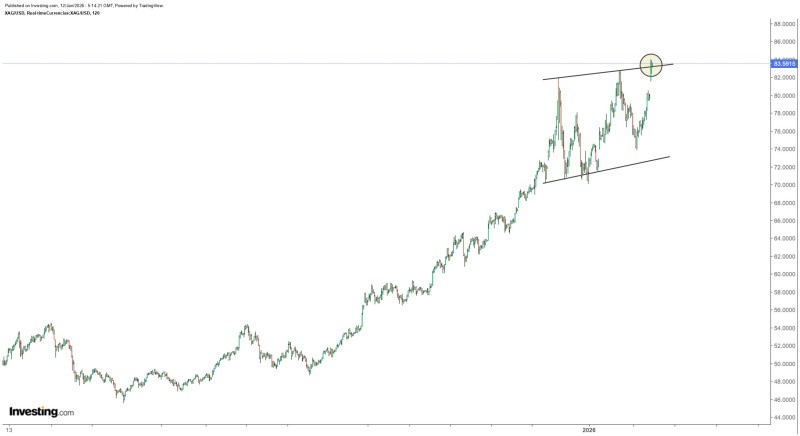

⬤ Here's the thing about silver right now—it's sitting in a really interesting spot after spending roughly 16 days just chopping around near recent highs. The XAGUSD chart shows price getting squeezed right below the upper edge of this rising consolidation structure, and it's coming after a pretty solid rally from mid-2025 levels. We're basically at one of those decision zones where things could get interesting fast.

⬤ The bigger picture still looks pretty healthy. Since setting up shop around $50 earlier in the trend, silver's been doing exactly what you want to see—making higher lows with pullbacks staying relatively shallow and controlled. This whole consolidation phase has been playing out inside an upward-sloping channel, which tells you that buyers keep stepping in to defend trend support instead of letting things slide deeper. Right now we're trading in that $83–$84 area, right up against the upper boundary of this consolidation range.

⬤ What's worth noting is that this looks more like compression than distribution. Volatility's been narrowing as silver hugs resistance, which suggests there's a standoff between buyers and sellers rather than aggressive selling. The fact that we haven't seen any sharp drops during this consolidation tells you selling pressure has been pretty limited. This is the kind of price action you typically see during pauses within bigger trends—markets digesting gains before volatility picks back up.

⬤ This setup matters for the wider precious metals space since silver tends to be more momentum-sensitive compared to gold. If we get sustained acceptance above this current consolidation area, it would reinforce the existing upward trend. If not, we're probably looking at more range-bound action. For now, silver's positioned near the upper edge of its recent structure, showing the market's consolidating strength rather than running out of steam.

Peter Smith

Peter Smith

Peter Smith

Peter Smith