The Eurozone's GDP numbers for Q1 2024 might look pretty meh at first glance, but here's the thing – when you dig deeper and cut out Ireland's wild swings, the region actually grew a solid 0.29% quarter-over-quarter with really balanced growth across the board.

Why Eurozone Growth Looks Way Better When You Exclude Ireland

The Eurozone's overall GDP growth looked pretty modest in Q1 2024, but that's mainly because Ireland's economy is basically doing its own crazy thing that has nothing to do with the rest of Europe. When you strip Ireland out of the equation, suddenly you get a much clearer picture of what's actually going on.

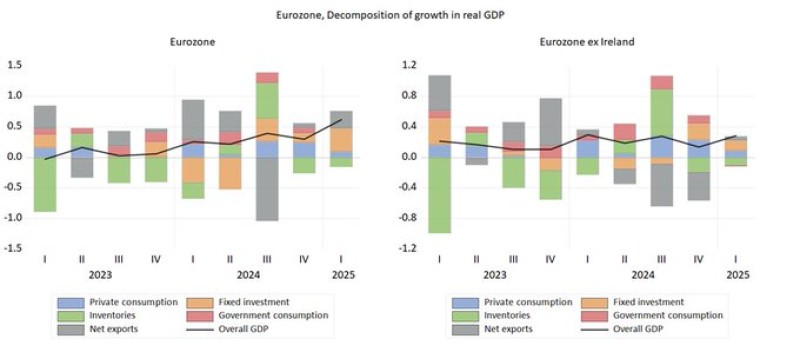

The chart this trader shared is pretty eye-opening. The left side shows the full Eurozone bouncing around below 0.5% growth for most of 2023 and early 2024, with this weird spike in Q3 2024. But when you look at the right panel showing "Eurozone ex Ireland," you see way steadier momentum that actually makes sense.

Turns out Ireland's massive swings in fixed investment have been messing with the headline numbers big time. It's like having one really volatile stock in your portfolio that makes your whole portfolio look unstable even when everything else is doing fine.

The Eurozone's Growth Story Is Actually Pretty Well-Balanced Right Now

What's really encouraging about Q1 2024 is how balanced the growth was when you exclude Ireland. The right panel of that chart shows private consumption, government spending, and fixed investment all chipping in with solid contributions. That's exactly what you want to see – not just one sector carrying everything, but broad-based growth across the economy.

Net exports and inventories weren't huge factors, but they stayed relatively stable, which is actually good news. Remember, Q1 2023 got hammered by inventories dropping about 1.0%, but since then that drag has been shrinking or even turning slightly positive.

By Q1 2024, both government consumption and private consumption were pulling their weight with positive contributions. That tells you domestic demand is actually pretty healthy, which is way more sustainable than growth that depends on exports or some temporary boost.

Don't Expect This Growth Story to Fall Apart in Q2

Here's where it gets interesting – the trader pointed out there's "not much reason to expect a straightforward reversal" heading into Q2 2024. And honestly, that makes total sense when you look at how solid the foundation of Q1's growth was.

This wasn't some fluke bounce-back from a terrible quarter or a one-time spike that's gonna disappear. The blue line tracking overall GDP in both panels shows this consistent upward trend continuing into early 2025, and when you've got balanced contributions from all the core sectors, that's usually a sign things can keep going.

Sure, Ireland's gonna keep doing its volatile thing and probably mess with the headline numbers. But the broader Eurozone economy looks like it's found its groove and is on a pretty sustainable path. When you've got diverse growth drivers instead of just one sector doing all the heavy lifting, that's when you know the recovery has some real legs under it.

The bottom line? Don't get fooled by those headline Eurozone GDP numbers. Strip out Ireland's noise, and you've got an economy that's actually doing pretty well with the kind of balanced growth that tends to stick around.

Peter Smith

Peter Smith

Peter Smith

Peter Smith