Colombia is grappling with persistent inflation pressures as new data exposes the gap between actual price growth and official targets. With annual inflation sitting at 5.35%—nearly double the central bank's objective—and money supply expanding faster than levels historically associated with price stability, the South American nation faces a monetary policy challenge that highlights the fundamental relationship between liquidity and inflation.

Colombia's Inflation Exceeds Target by 78% as M3 Growth Outpaces Stability Threshold

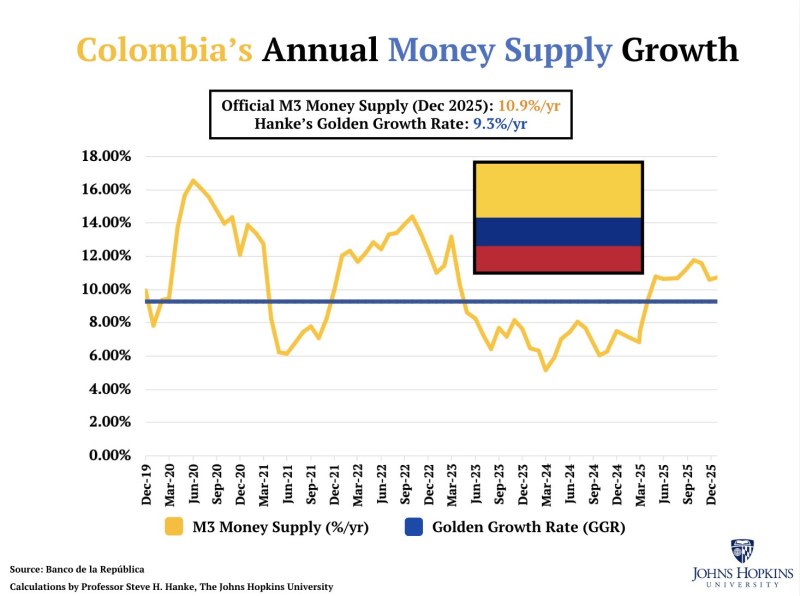

Colombia's latest numbers paint a concerning picture for price stability. Annual inflation landed at 5.35%, significantly above the 3% target set by monetary authorities. Meanwhile, the country's M3 money supply ballooned by 10.9% year-over-year, surpassing the 9.3% Golden Growth Rate—the benchmark level economists consider consistent with hitting inflation targets.

The chart tracking Colombia's money supply tells the story visually: M3 growth sits comfortably above the Golden Growth Rate benchmark, signaling that monetary expansion is running hotter than the pace associated with the target inflation path. This pattern isn't unique to Colombia—similar dynamics between liquidity expansion and price pressures have emerged in US money supply growth trends and broader global monetary expansion.

According to economist Steve Hanke, When broad money grows faster than the benchmark rate, inflation tends to remain above target.

Money Supply and Inflation: Understanding the Connection

The framework here is straightforward: inflation behavior tracks monetary conditions more closely than temporary shocks. When money supply growth exceeds the benchmark threshold, price increases typically stay elevated above target ranges. Colombia's current figures fit this pattern perfectly—the 10.9% M3 expansion aligns with the 5.35% inflation reading, both sitting above their respective stability benchmarks.

This relationship emphasizes that Colombia's inflation challenge isn't just about supply chain disruptions or short-term price spikes. Instead, the data frames the inflation environment as fundamentally connected to how fast money is being created and circulated through the economy. With liquidity expanding at 10.9% while the Golden Growth Rate sits at 9.3%, the excess monetary growth provides ongoing fuel for above-target price increases.

The takeaway for policymakers and investors: Colombia's inflation won't meaningfully retreat toward the 3% target until money supply growth decelerates toward—and ideally below—the 9.3% benchmark level.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi