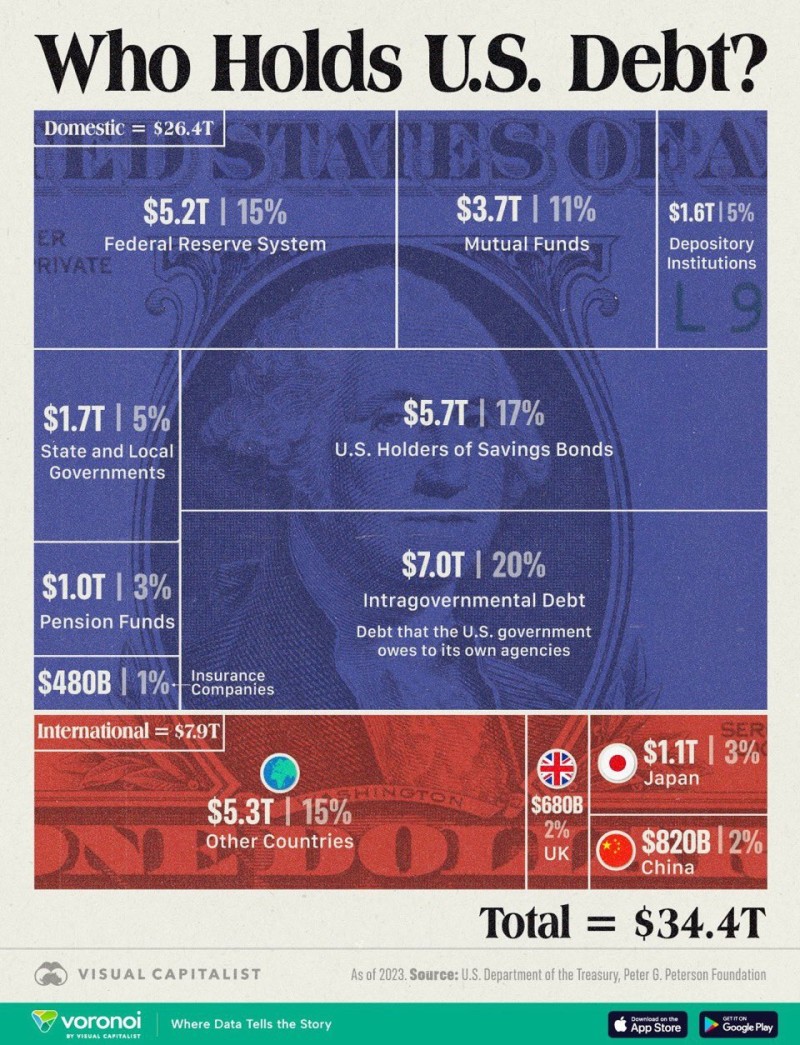

Who's actually lending money to the U.S. government? With total debt at $34.4 trillion, the answer matters for interest rates, global politics, and market stability. The breakdown shows some surprising patterns.

$34.4 Trillion: Who Actually Owns America's Debt

Short Description: New data breaks down how U.S. debt is split between domestic institutions and foreign governments, showing the changing landscape of global financial power.

Understanding the Big Picture

Figuring out who's lending money to the U.S. government has become one of the biggest economic questions right now.

With total debt reaching $34.4 trillion, who holds it matters for everything from interest rates to global politics and market stability. The breakdown reveals some interesting patterns that aren't always obvious.

Domestic Holders Dominate

American institutions and agencies hold the vast majority of U.S. debt—about $26.4 trillion total. The biggest chunk is intragovernmental debt at $7.0 trillion (20%), which is essentially money the federal government owes itself through programs like Social Security and federal retirement funds.

Other major domestic holders include:

- Federal Reserve System holds $5.2 trillion (15%), making it a major player in bond markets and monetary policy

- U.S. Savings Bond holders account for $5.7 trillion (17%), representing individual Americans' investments

- Mutual Funds control $3.7 trillion (11%), connecting everyday investors to government debt

- State and Local Governments own $1.7 trillion (5%), using Treasuries as safe investments

- Banks and Depository Institutions hold $1.6 trillion (5%), keeping them as reserve assets

- Pension Funds manage $1.0 trillion (3%), securing retirement money in government bonds

- Insurance Companies maintain $480 billion (1%) in their portfolios

This shows how deeply U.S. debt is embedded in America's own financial system—from retirement accounts to banks and investment funds that ordinary people rely on.

Foreign Holdings Are Smaller Than Expected

International holders own $7.9 trillion of U.S. debt. Japan leads foreign lenders with $1.1 trillion (3%), followed by China at $820 billion (2%) and the United Kingdom at $680 billion (2%). All other countries combined hold $5.3 trillion (15%).

China's declining stake is notable—reflecting geopolitical tensions, diversification strategies, and better yields available elsewhere. The overall picture shows America is less dependent on foreign buyers than many people assume.

What This Means Going Forward

The distribution of debt holders tells us several important things. First, low reliance on foreign buyers means less exposure to international political drama. Second, heavy domestic concentration means U.S. financial institutions are closely tied to Treasury performance—what happens to government bonds directly affects banks, pension funds, and insurance companies.

Rising intragovernmental debt also points to growing pressure on programs like Social Security. And the Federal Reserve's massive $5.2 trillion position means its policies will continue driving markets significantly.

As borrowing costs climb and global demand shifts, this ownership map becomes increasingly critical for understanding risk. Investors are watching whether domestic institutions can keep absorbing new debt—or if geopolitical changes might force America to rely more on international lenders in the future.

Usman Salis

Usman Salis

Usman Salis

Usman Salis