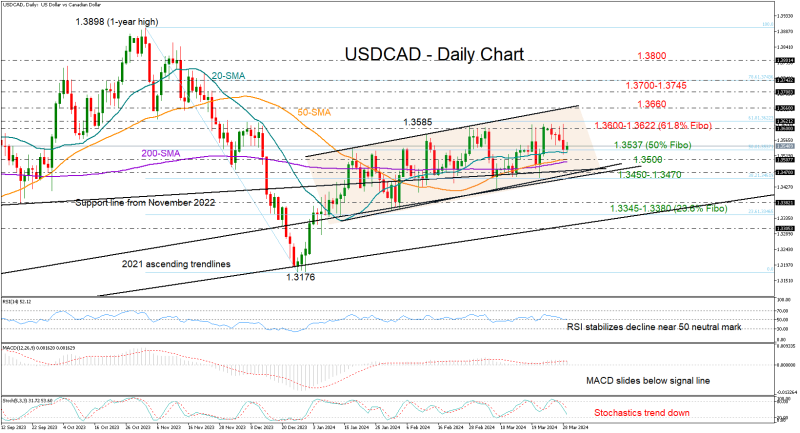

USDCAD's current consolidation near the 20-day SMA suggests a temporary pause in the recent downward trend, offering traders a pivotal moment to reassess their positions. As market participants navigate the holiday period, attention will likely remain on key technical levels for clues about the pair's next directional move.

USDCAD Finds Support Amid Easter Trading

USDCAD displayed a soft positive momentum, hovering around 1.3547 during early European trading hours on Friday, as investors prepared for the Easter holiday break.

Technically, USDCAD found support near its 20-day simple moving average (SMA) following a four-day decline. Notably, the SMA lines have served as pivotal points throughout March, heightening the likelihood of an upside reversal as long as the price maintains above the 1.3500 region. Additionally, the trendline zone, situated slightly lower at 1.3450-1.3470, may act as a barrier against a bearish breakout, potentially steering the pair away from the 1.3345-1.3380 constraining area.

Mixed Signals for Bulls

Despite the potential for an upside reversal, technical indicators present a mixed outlook for bullish sentiment. While the Relative Strength Index (RSI) endeavors to turn higher near its 50 neutral mark, the stochastic oscillator has initiated a new negative cycle, and the Moving Average Convergence Divergence (MACD) has descended below its red signal line, indicating a lingering bearish sentiment.

However, should the 20-day SMA maintain its support, a reversal towards the upside could see USDCAD revisiting the psychological level of 1.3600. Further bullish momentum may be awaited if the price breaches the channel’s upper band at 1.3660, potentially paving the way towards the 1.3700-1.3745 territory and beyond to the 1.3800 level.

Conclusion

In conclusion, while technical signals may not overwhelmingly favor bulls, the possibility of a recovery phase in USDCAD remains plausible, particularly as the pair tests a significant support zone amidst Easter trading.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah