The EUR/USD pair is displaying a solid recovery pattern on shorter timeframes, suggesting buyers are back in control after a technical bounce from a critical support area. With price action reclaiming key imbalance zones and building higher lows, the focus has shifted toward the 1.1605 level as the next logical target for euro bulls.

Euro Strengthens as Price Rebounds from Discount Zone

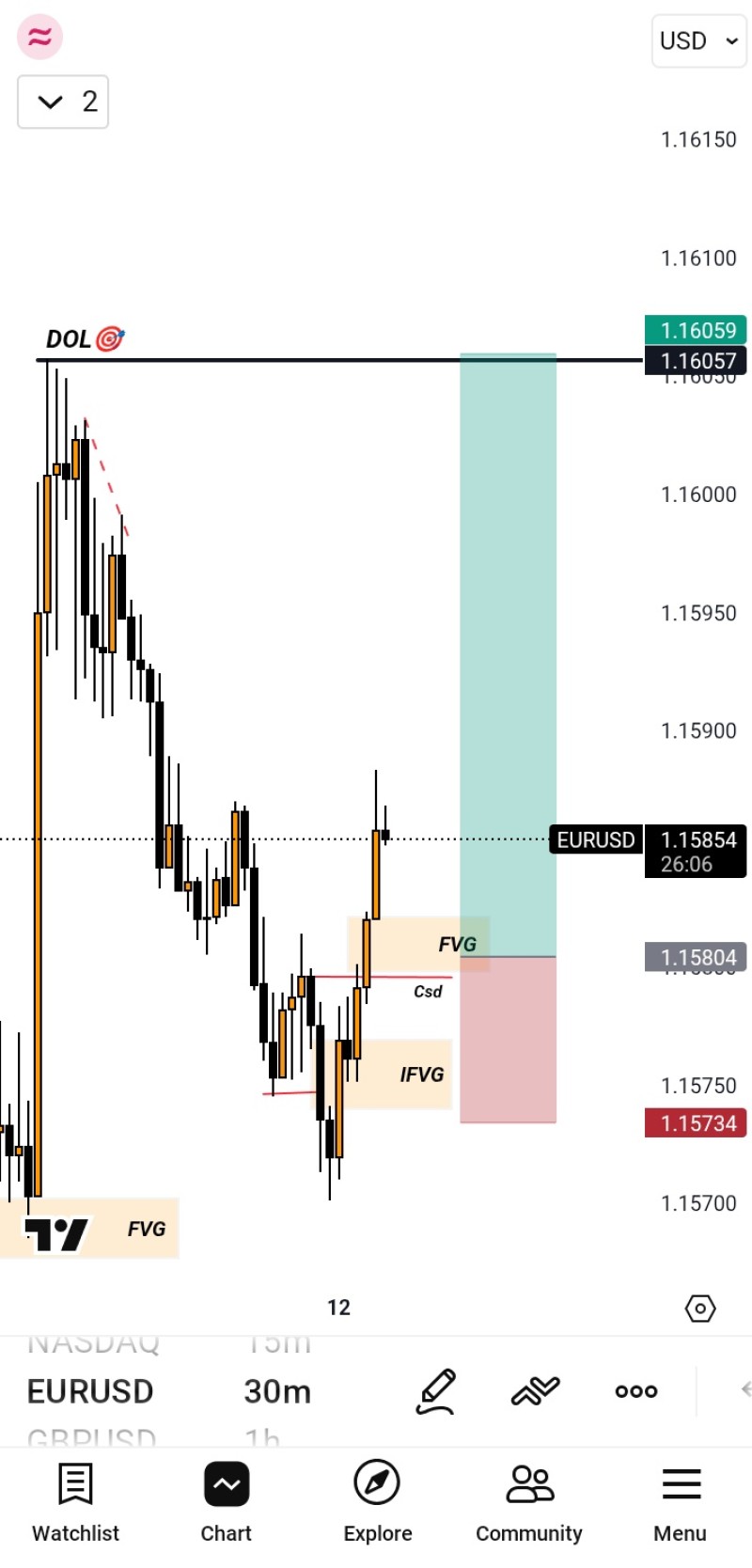

The pair is showing a confident recovery on the 30-minute chart, signaling potential continuation toward 1.1605. This move follows a clean rebound from a discount zone and Fair Value Gap, pointing to a shift in short-term order flow favoring buyers.

After tapping into the Imbalance Fair Value Gap near 1.1573, price found support and reversed sharply. The subsequent bullish candles formed higher lows, confirming the start of a new impulsive phase toward the Daily Open Level around 1.1605.

Technical Analysis: Key Market Zones

Support Area: The 1.1573–1.1580 zone acted as a clear support base, where the IFVG filled and buyers stepped in decisively. This region aligns with prior liquidity grabs and now serves as a short-term bullish pivot zone. Resistance Target: The primary resistance lies at 1.1605, corresponding to the Daily Open Level. This is the immediate upside objective for intraday traders, with potential for continuation toward 1.1610 if momentum remains strong. Market Structure: The pair has transitioned from a bearish correction into a bullish structure, forming higher highs and higher lows. The reclaim of the FVG confirms that institutional order flow is shifting upward, favoring continuation toward the next liquidity pool.

Broader Context and Fundamentals

The euro's rebound coincides with a temporary pause in dollar strength, as traders weigh upcoming macro data and dovish expectations from the Federal Reserve. Softer Treasury yields and slightly improved eurozone sentiment are helping EUR/USD maintain support above 1.1580. Market participants are also watching for fresh catalysts from the U.S. CPI release and ECB commentary later in the week, which could determine whether the pair sustains its bullish structure or consolidates near current levels.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov