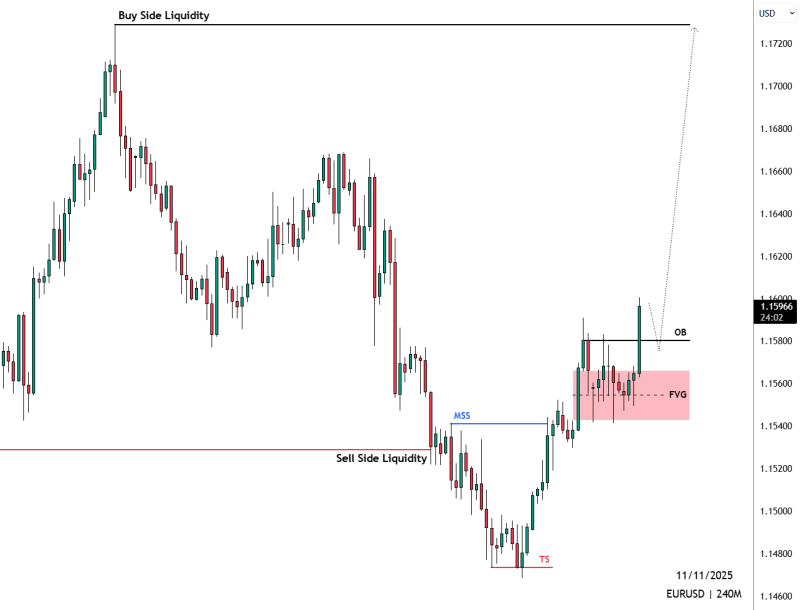

EUR/USD has shown a meaningful shift in market structure on the 4-hour chart, signaling that the recent downtrend may be over. After sweeping lower liquidity zones and reclaiming key technical levels, the pair appears ready to push higher toward significant liquidity pools above current price.

Technical Setup

Price reversed after taking out Sell-Side Liquidity near 1.1480 in the "TS" zone. This liquidity sweep triggered a Market Structure Shift, marking the end of downside pressure. The move into and repeated respect of the Fair Value Gap confirmed that demand was building, with buyers stepping in consistently at this level.

The MSS marked the first real bullish signal—price started making higher highs and higher lows, which is what you need to see for continuation. The Fair Value Gap became a reliable demand zone where buyers kept showing up, and this kind of pattern usually leads to stronger directional moves once the imbalance gets filled.

Breaking above the Order Block around 1.1580 was another key moment. That strong close above this level suggests institutional money is coming in and pushing price higher. The next logical target is the Buy-Side Liquidity zone near 1.1720, which lines up with a major prior high. When price reclaims structure like this, it tends to gravitate toward those liquidity pools.

The macro picture supports this too. Softer U.S. rate expectations and more stable European data are creating a better environment for EUR strength.

What to Watch

As long as EUR/USD holds above the reclaimed Order Block and stays above the Fair Value Gap zone, the path toward 1.17 stays open. A deeper pullback into the FVG would just be a retest, but right now momentum is clearly bullish. With technical structure and macro conditions both aligned, EURUSD looks positioned for continued upside toward higher liquidity targets.

Peter Smith

Peter Smith

Peter Smith

Peter Smith