The EUR/USD currency pair has been stuck in a sideways trading pattern recently, creating a clear range that traders are watching closely. With the pair hovering around key technical levels, market participants are positioning for what could be the next significant move as economic data and central bank policies continue to influence the dollar-euro dynamics.

EURUSD Price Analysis: Range-Bound Market Setting the Stage

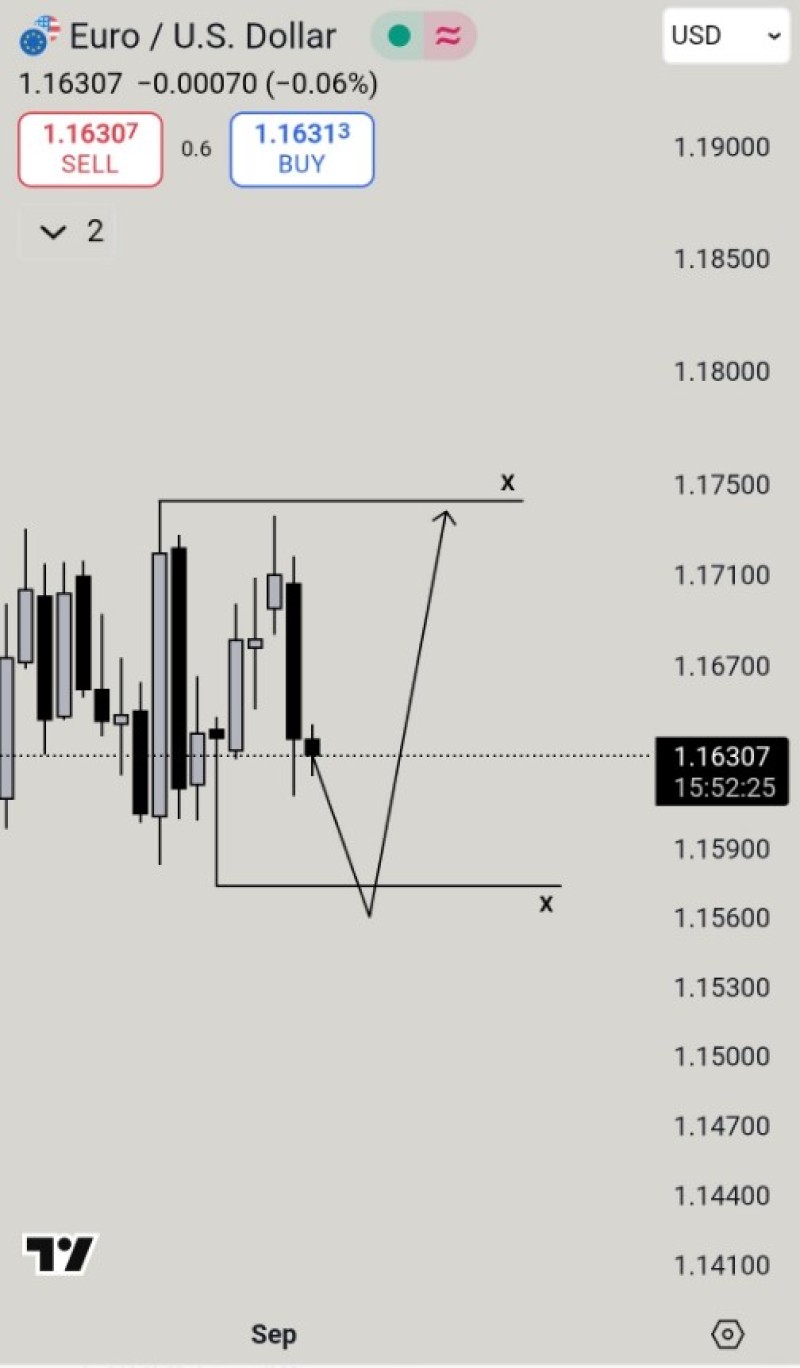

EUR/USD is currently trapped in sideways movement between 1.1560 and 1.1750. The pair is hanging around 1.1630 right now, and traders are keeping a close eye on what happens next.

Popular trader @mhtrading_smc posted a chart showing that once the price dips below the swing low near 1.1560, it might catch some late sellers off guard before bouncing back toward the top of the range. His analysis simply states: "EURUSD moving on ranges. After taking this swing low, upside move expected."

Support: 1.1590–1.1560 (swing low zone)

Resistance: 1.1670–1.1710

Upper Range Target: 1.1750

Extended Resistance: 1.1800–1.1850

Deeper Supports if Broken: 1.1500 and 1.1440

Right now, EUR/USD is trading around 1.1630, moving carefully but staying within its established boundaries. A quick drop to 1.1560 could set up a nice bounce back up, which is pretty typical behavior for range-bound markets.

EURUSD Price Outlook in Broader Context

The bigger picture shows why we're seeing this back-and-forth action. The dollar is staying strong because of higher U.S. interest rates and expectations about Fed policy, while the euro is holding its ground thanks to better economic data from Europe. This push and pull has created the current trading range.

Key economic reports coming up - like U.S. jobs numbers, European inflation data, and comments from central bank officials - will likely determine whether EUR/USD breaks toward 1.1750-1.1850 or falls back to test lower support levels.

The setup looks pretty clear: EUR/USD might dip down to sweep that 1.1560 low before rallying back toward 1.1750. As long as the bottom of the range holds up, the odds seem to favor a move back to the upside.

Peter Smith

Peter Smith

Peter Smith

Peter Smith