The EUR/USD pair continues its descent, reflecting broader dollar strength and shifting market sentiment. As technical indicators align with bearish price action, traders are positioning for a potential test of key support levels that could determine the pair's near-term direction.

EUR/USD Price Action Points Lower

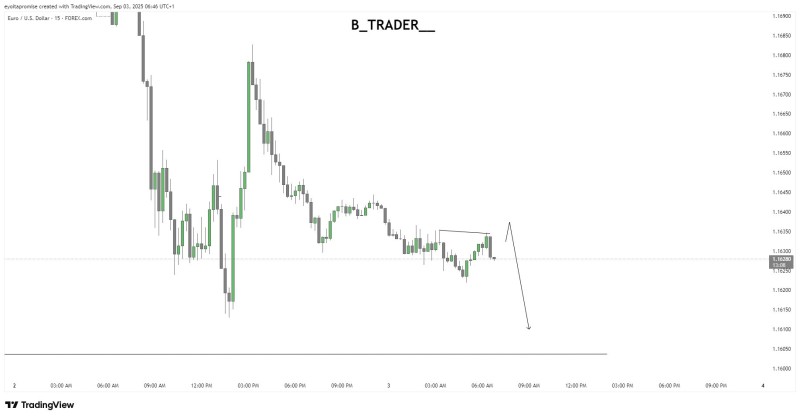

EUR/USD is trading around 1.1628, showing clear signs of weakness after failing to sustain higher levels. The pair has been grinding lower over recent sessions, with each bounce meeting fresh selling interest.

Market participants are watching closely as the downtrend gains traction. Famous trader captured the prevailing sentiment perfectly, noting that sellers remain firmly in control of the short-term structure.

His confidence in the ongoing bearish momentum reflects what many technical analysts are seeing across the charts.

Technical Picture Favors Further Declines

The current chart setup shows EUR/USD breaking below minor support levels, with momentum indicators pointing south. Price action suggests that any rallies are being viewed as selling opportunities rather than genuine recovery attempts.

The 1.1650 level now serves as immediate resistance. Without a convincing break back above this area, the path of least resistance remains downward toward the 1.1600 psychological support zone.

Market Dynamics Support Dollar Strength

Several factors are working against the euro in the current environment. Dollar demand continues to find support from various sources, while European economic uncertainties add to the selling pressure on EUR/USD.

The broader risk sentiment also plays a role, with investors showing preference for the perceived safety of the greenback during periods of market uncertainty.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah