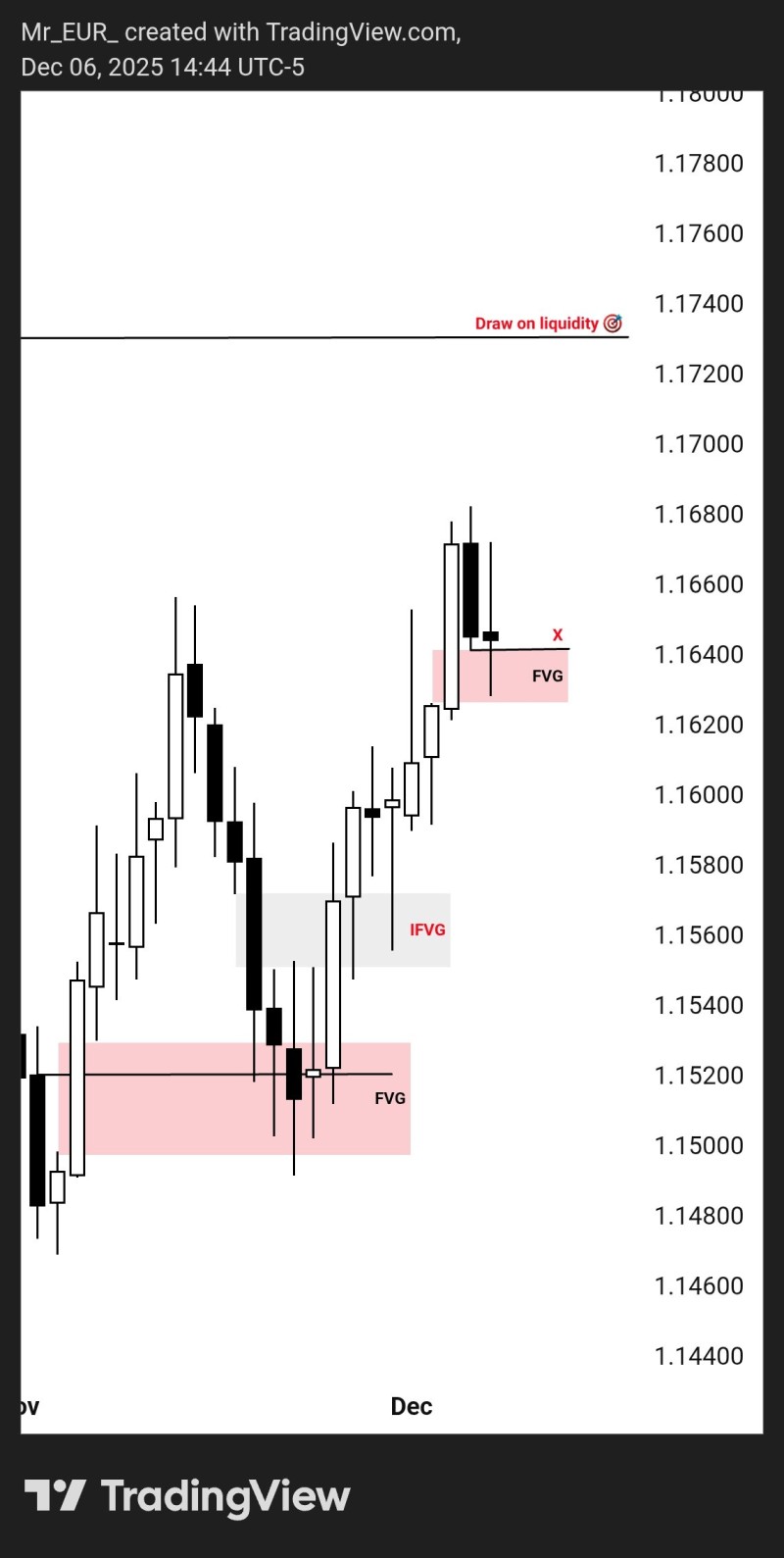

⬤ EUR/USD keeps building higher on the daily chart, heading toward a liquidity zone marked near 1.17400. The pair's been climbing through several imbalance areas, with recent price action testing a fair value gap sitting around 1.16400. Right now there's some consolidation happening in this zone—basically the market's taking a breather after a solid run of green candles, trying to figure out if there's enough juice left to push even higher.

⬤ Looking at the chart, you can see multiple imbalances that formed during this rally. There's a broader FVG region down below 1.15400 and another zone near 1.15600. EUR/USD moved up from these lower levels, filling earlier gaps and tightening up as it hit the mid-1.16 area. The red FVG around 1.16400 is worth watching—it's a spot where we could see some reaction. Those wicks near 1.16800 tell us buyers are still in the game but running into some resistance.

⬤ The real target here is that liquidity draw up at 1.17400. If the bullish momentum holds, EUR/USD could make a run for that level as the market tries to fill the remaining gap above. But here's the thing—there are still open FVG zones sitting below current price, which means a pullback toward 1.15600-1.15400 is definitely on the table if buyers start losing steam. The interplay between these filled and unfilled imbalances is what's setting up the next move.

⬤ Liquidity zones and imbalance structures tend to be magnets for price in trending markets. How EUR/USD handles the 1.16400 area and whether it actually reaches that 1.17400 liquidity level will show us if this uptrend has real legs—and it'll give us some solid clues about where FX markets are headed next.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov