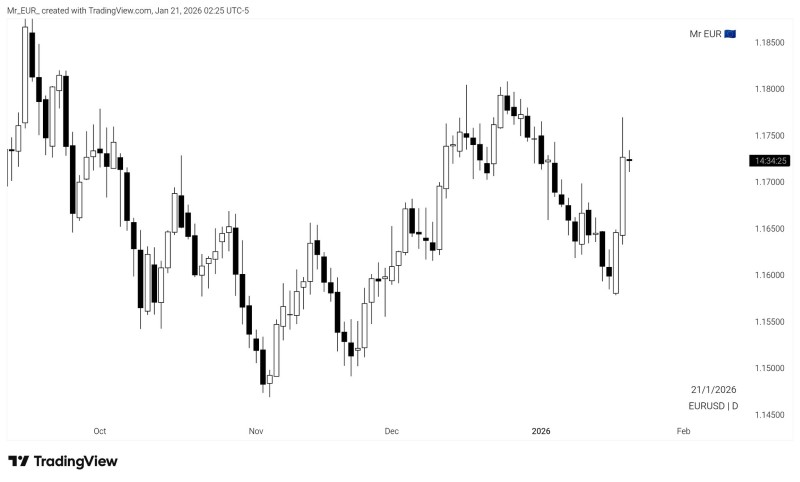

⬤ EUR/USD is stuck in a tight spot around 1.17 following a wild start to 2026. Right now, traders can't decide whether to buy or sell—there's no clear winner in this tug-of-war. The daily candles tell the story: one strong bullish push followed by... nothing. Momentum's shifted, sure, but it hasn't committed to anything yet.

⬤ Zoom out a bit and you'll see the pair sliding through October and November before finding its footing just above 1.15. From there, it clawed its way back up through late December, hitting the 1.17-1.18 zone before running out of steam. Early January brought sellers back into the game, pushing price lower until buyers showed up again near that same support level. What we're seeing now? A bounce off the lows—not necessarily a full trend flip.

⬤ The daily chart's basically flashing red and green in equal measure. Bullish candles, bearish candles, bullish candles—back and forth like a tennis match. Price has recovered toward the middle of its range, but it hasn't reclaimed those previous highs or started stacking higher highs. Translation: we're consolidating, not accelerating. The market's taking a breather, trying to figure out if this recent strength has legs.

⬤ This matters because EUR/USD often sets the tone for broader market sentiment and macro expectations. If we stay locked in this range near 1.17, expect more sideways grinding. But if volatility picks up? That could be the signal everyone's waiting for. For now, the chart's showing a pause after the rebound—stability over momentum while traders wait for the next real clue.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov