EUR/USD traders seem to be gearing up for more downside after the pair repeatedly failed to hold above 1.17. Sellers appear to have regained control, and the technical picture continues to favor those betting against the euro despite occasional market optimism.

EUR/USD Chart Analysis: Structure Remains Bearish

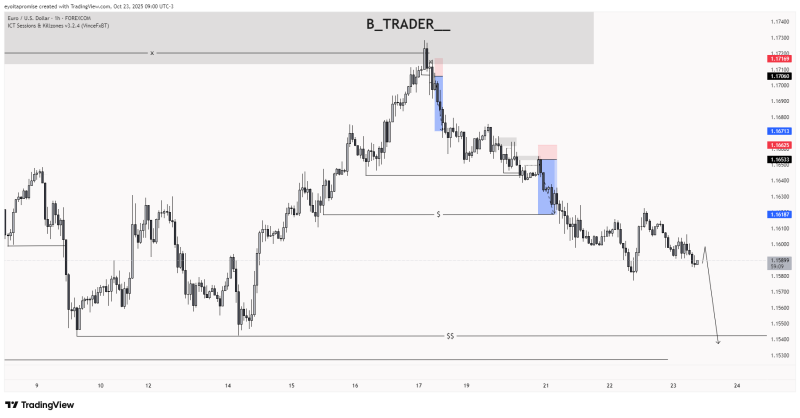

According to a recent chart shared by B Trader, the pair has rejected the 1.1710–1.1720 supply zone multiple times, where heavy resistance sits. This area marks a key spot where institutional sellers have been active, pushing the market back into a downward move. A strong bearish push confirmed the shift in sentiment after price swept liquidity above earlier highs. Since then, EUR/USD has been forming lower highs and lower lows—the classic signs of a developing downtrend.

Right now, the market is sitting near 1.1580 support, with the next major target at 1.1540. A clean break below this level could open the door to further losses, reinforcing the view that sellers still have the upper hand.

Key Drivers Behind the Weakness

The technical breakdown lines up well with what's happening in the broader economy. The U.S. dollar has been holding strong thanks to solid economic data and expectations that the Federal Reserve won't be cutting rates anytime soon. Meanwhile, the Eurozone has been dealing with sluggish industrial output and fading business confidence. These fundamental pressures are adding weight to the bearish technical setup, creating a scenario where both charts and economics point in the same direction.

What to Watch Next

Unless EUR/USD can push back above the 1.1650–1.1670 range with real conviction, the bias stays negative. A confirmed drop below 1.1580 would likely trigger more selling toward 1.1540, signaling that bears are still in charge. Short-term traders should keep an eye on whether liquidity below 1.1550 sparks a reaction or if the pair just keeps sliding lower as dollar strength persists.

Peter Smith

Peter Smith

Peter Smith

Peter Smith