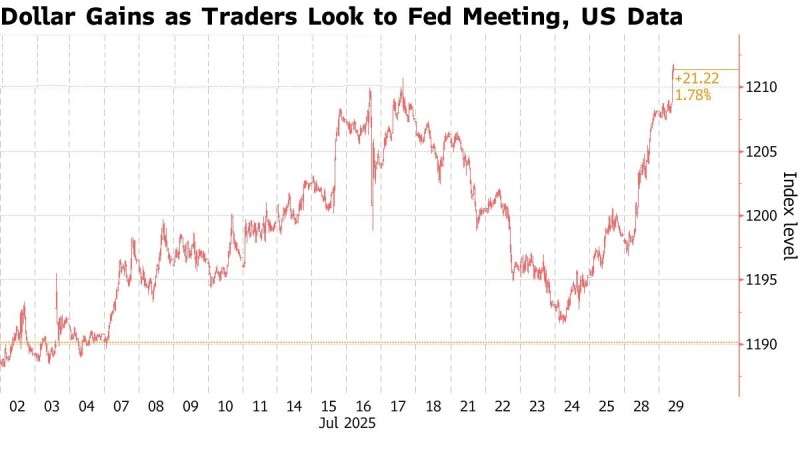

The dollar just crushed it, hitting its best level in over five weeks. The jumped 0.3% to levels we haven't seen since June 23, beating every other major currency. The euro got hammered especially hard, dropping to its weakest point in more than a month.

Why the sudden surge? Traders are betting that this week's US economic data will show just how strong America's economy really is. Consumer confidence numbers are expected to improve for July, and job openings data drops Tuesday. If Americans are feeling good and companies are still hiring, that's dollar rocket fuel.

"For now at least, the focus for FX market participants has shifted away from the trade uncertainty and on to the resilience of the US economy," said Derek Halpenny from MUFG. "That is clearly helping to prompt some short dollar position liquidation built up through the first half of the year."

USD Strength Builds Ahead of Fed Meeting

Wednesday's Fed meeting is the main event. Everyone expects rates to stay put, but what matters is whether they sound confident about the economy. If the Fed doesn't seem eager to cut rates aggressively, the dollar could get another boost.

The greenback has been recovering from earlier losses as trade uncertainty finally clears up. The EU and US struck a trade deal Sunday, and Commerce Secretary Howard Lutnick says a 90-day China extension looks likely. Not earth-shattering, but it removes some question marks.

USD Price Gets 'American Exceptionalism' Boost

The narrative over the coming weeks will turn to focus on Europe's sluggish economy, constrained fiscal room in certain key countries, disappointing real yields and now a trade loss to boot. Expect a lot of chatter about US exceptionalism making a comeback.

Translation: When Europe's struggling and other economies have problems, America looks pretty good. Treasury yields are sitting at 3.92%, and traders still bet 60% odds on a September Fed cut. But if data keeps coming in strong, those bets could change fast.

Valentin Marinov from Credit Agricole thinks the Fed won't rush into dovish talk. "The USD could receive a boost if the outcome of the July policy meeting and data releases keep markets guessing about the timing and aggressiveness of Fed easing."

Bottom line: The dollar's strength isn't just one good day. It's about America looking solid while others face challenges. Whether this continues depends on whether the data actually delivers.

Peter Smith

Peter Smith

Peter Smith

Peter Smith