Intro

XM forex broker is a reputable and well-established broker that has been providing forex and CFD trading services since 2009. The broker is regulated by several reputable financial authorities, including CySEC, FCA, and ASIC, and offers a wide range of trading instruments, including forex, stocks, commodities, and cryptocurrencies. XM is known for its competitive trading conditions, including low spreads, high leverage, and support for short selling.

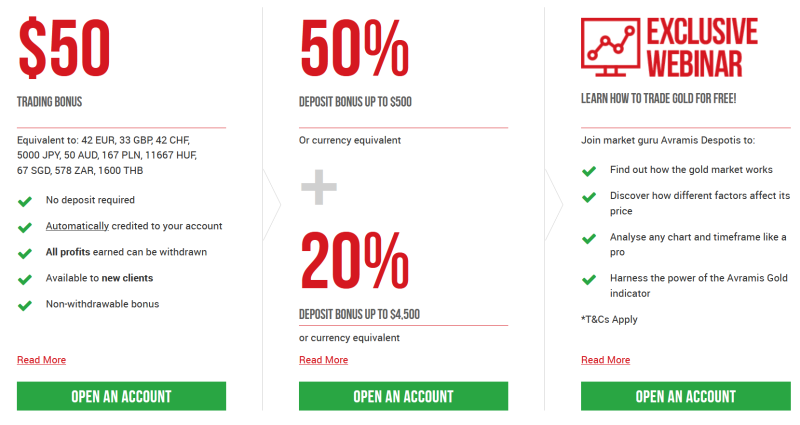

The broker also offers bonus offers, trading contests, and a loyalty program to reward its clients. XM has a strong focus on customer support, with multilingual customer support available 24/5 via phone, email, and live chat. The broker has a user-friendly trading platform, including MetaTrader 4 and 5, and offers educational resources and research tools to help traders improve their skills and knowledge.

XM Head Office

XM forex broker's head office is located in Limassol, Cyprus, a city known for its thriving financial sector and attractive tax regime. The office is situated in the heart of Limassol's business district and features modern facilities and state-of-the-art technology. As of 2023, XM has over 450 employees working in its head office, including traders, analysts, customer support staff, and administrative personnel. The company has a multinational and diverse workforce, with employees from over 20 different countries. The head office serves as the hub for XM's global operations, overseeing the broker's activities in multiple jurisdictions and ensuring compliance with regulatory requirements.

XM Regulation and Money Safety

XM is regulated by several reputable financial authorities, including the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA) in the UK, and the Australian Securities and Investments Commission (ASIC). This means that the broker is required to adhere to strict rules and standards to ensure the safety and security of clients' funds.

XM also offers negative balance protection, which means that traders cannot lose more than their account balance, even in volatile market conditions. In addition, the broker uses segregated accounts to keep clients' funds separate from its own operating funds, which further enhances money safety.

XM Minimal Deposit

XM offers different account types, including a Micro account with a minimum deposit of just $5, a Standard account with a minimum deposit of $5, and a Zero account with a minimum deposit of $100. The Zero account features tighter spreads but charges a commission per lot traded.

XM Bonus Offers

XM offers various bonus offers to its clients, including a 30% deposit bonus up to $1,000, a $30 no-deposit bonus, and a loyalty program that rewards traders with XM points that can be redeemed for credit bonuses or other rewards. However, it's important to note that bonus offers often come with terms and conditions, such as minimum trading volumes, that traders must meet before they can withdraw the bonus or any profits made from it.

XM Trading Contests

XM also runs regular trading contests that offer cash prizes to the winners. These contests can be a fun way for traders to test their skills and compete against other traders, but they also carry higher risks and should not be seen as a reliable way to make profits.

XM Advantages

- Strong Regulations: XM is regulated by several reputable financial authorities, including CySEC, FCA, and ASIC, which ensures that the broker adheres to strict rules and standards to protect clients' funds and provide a safe and secure trading environment.

- Wide Range of Trading Instruments: XM offers a wide range of trading instruments, including forex, stocks, commodities, and cryptocurrencies, which allows traders to diversify their portfolios and take advantage of different market conditions.

- Competitive Trading Conditions: XM offers competitive trading conditions, including low spreads, high leverage (up to 1:888), and support for short selling, which can help traders maximize their profits and minimize their risks.

- User-Friendly Trading Platforms: XM offers a user-friendly trading platform, including MetaTrader 4 and 5, which allows traders to easily execute trades, analyze market data, and manage their accounts.

- Strong Customer Support: XM has a strong focus on customer support, with multilingual customer support available 24/5 via phone, email, and live chat. The broker also offers educational resources and research tools to help traders improve their skills and knowledge.

- Low Minimum Deposit: XM offers different account types, including a Micro account with a minimum deposit of just $5, which makes it accessible to traders with different budgets

- Bonus Offers and Trading Contests: XM offers various bonus offers, such as a 30% deposit bonus up to $1,000, and regular trading contests that offer cash prizes to the winners, which can be appealing to some traders.

Overall, XM forex broker has several advantages that make it a popular choice among traders, including strong regulations, a wide range of trading instruments, competitive trading conditions, user-friendly trading platforms, strong customer support, low minimum deposit requirements, and bonus offers and trading contests.

XM Disadvantages

- Limited Educational Resources: XM's educational resources and research tools may not be sufficient for beginner traders who need more guidance and support to learn the basics of forex trading. The broker could benefit from offering more comprehensive educational materials to its clients.

- Commission on Zero Account: XM charges a commission per lot traded on its Zero account, which may not be suitable for traders who prefer to avoid paying extra fees. Some traders may prefer the Standard or Micro account types, which do not charge a commission.

- Limited Cryptocurrency Offerings: Although XM offers a range of trading instruments, its cryptocurrency offerings are relatively limited compared to some other brokers. Traders who are specifically interested in trading cryptocurrencies may want to consider other options.

- Limited Trading Tools: XM's trading platform is user-friendly, but it may lack some of the advanced trading tools and features that more experienced traders look for, such as customizable charts and advanced order types.

- No US Clients: XM does not accept clients from the United States, which can be a disadvantage for traders based in the US who are looking for a reputable forex broker.

Overall, while XM has several advantages, it also has some potential drawbacks that traders should keep in mind when considering the broker. These include limited educational resources, a commission on its Zero account, limited cryptocurrency offerings, limited trading tools, and no US clients.

Conclusion

Overall, XM is a reputable and reliable forex broker that offers a wide range of trading instruments, strong regulations and money safety measures, and competitive trading conditions. However, like any broker, it has its strengths and weaknesses, and traders should carefully consider their own needs and preferences before choosing a broker. Whether you're a beginner or an experienced trader, it's always a good idea to do your research, compare different brokers, and choose the one that best fits your trading goals and style.

Editorial staff

Editorial staff

Editorial staff

Editorial staff