While the crypto market appears calm on the surface, something significant is happening beneath the waves. XRP whales - the largest token holders - are quietly making moves that could reshape the market landscape. Recent data reveals the most aggressive buying pattern in XRP's entire history, with implications that extend far beyond typical market fluctuations.

Record-Breaking Whale Activity

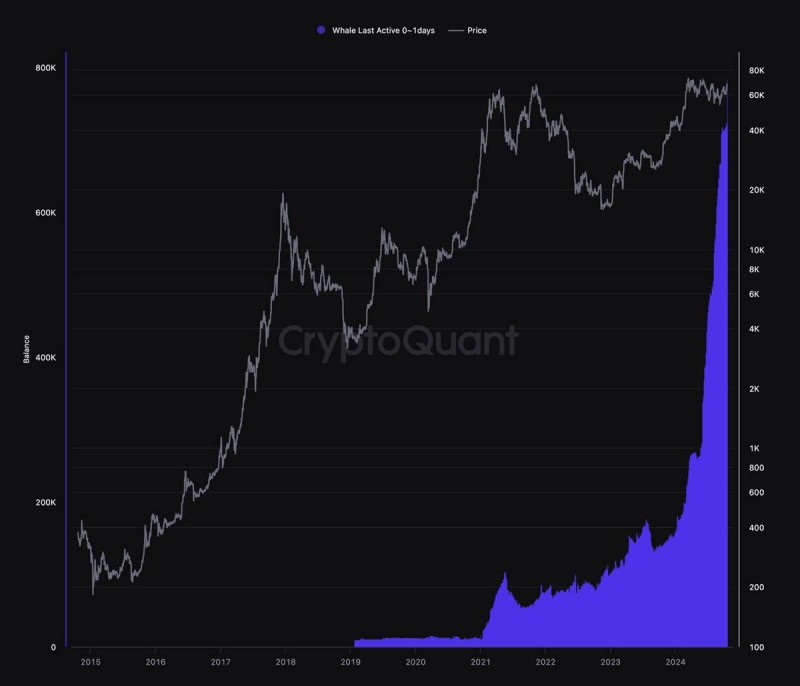

Fresh analysis from Coin Bureau shows that whale wallets are accumulating XRP at breakneck speed. CryptoQuant data confirms this trend, with the metric tracking active whale wallets (0-1 days) shooting vertical since late 2023 and hitting historic peaks in 2025. This level of accumulation dwarfs even the legendary bull runs of 2017 and 2021, suggesting something bigger might be brewing.

Whale accumulation typically serves as a reliable indicator of growing institutional confidence and often precedes significant price movements. When the smart money moves, retail investors usually take notice.

The Price-Activity Disconnect

What makes this situation particularly intriguing is the stark contrast between whale behavior and price action. While XRP's price hovers near its upper consolidation range without breaking all-time highs, whale accumulation has exploded upward. This divergence suggests that major players are positioning themselves for what they anticipate could be a substantial breakout, accumulating while prices remain relatively accessible.

Behind the Buying Spree

Several catalysts likely drive this unprecedented accumulation. Ripple's ongoing legal victories against the SEC have significantly improved regulatory clarity, boosting investor confidence. Meanwhile, the company's expanding partnerships with banks and payment networks, particularly across Asia and the Middle East, demonstrate real-world utility growth. The broader macro environment also plays a role, with cooling inflation and potential central bank rate cuts making risk assets like crypto more attractive.

Market Implications

While whale accumulation signals strong conviction, investors should temper expectations with realism. Heavy institutional buying doesn't guarantee immediate price rallies - these moves often take time to materialize in market prices. However, if XRP maintains its current support levels, the foundation for a significant breakout appears to be forming. Should support fail, expect continued volatility before any upward momentum gains traction.

The current scenario presents both opportunity and risk. Whales clearly see value at these levels, but timing remains crucial for retail participants.

Peter Smith

Peter Smith

Peter Smith

Peter Smith