Binance's XRP holdings have hit their lowest point in over a year, raising questions about what this means for the token's market dynamics. When one of the world's largest crypto exchanges sees such a dramatic drop in reserves, traders pay attention—because reduced supply on exchanges often signals accumulation by long-term holders or institutions moving assets into cold storage.

Binance XRP Reserves Hit Lowest Levels Since Early 2024

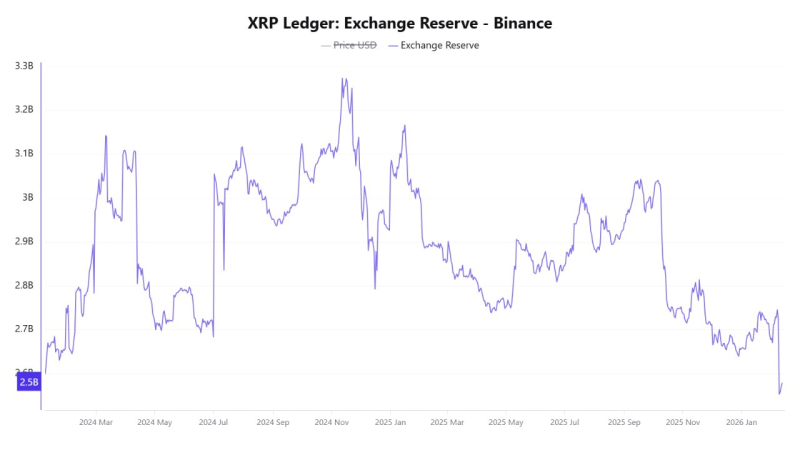

XRP balances held on Binance have declined to their lowest level since early 2024. The chart tracking XRP Ledger exchange reserves shows a steady reduction in tokens held on the platform following a peak in late 2024.

Binance reserves stood near 3.2 billion XRP around November 2024 but have since dropped by approximately 700 million tokens. This isn't just a temporary dip—it represents a significant contraction in liquid XRP available on the exchange. Similar patterns emerged when XRP reserves record historic jump across exchanges and when XRP price jumps as whales move $500M off exchanges, where exchange balances shifted rapidly alongside major liquidity changes.

What 700M Fewer Tokens Means for XRP Liquidity

The reserve trend shows a gradual drawdown through 2025 toward levels last seen at the start of 2024. When a major trading venue like Binance experiences reduced balances, it typically indicates tighter on-platform liquidity conditions. This matters because fewer tokens available for immediate trading can amplify price movements when demand spikes.

This liquidity-driven behavior mirrors patterns discussed in XRP price analysis: velocity jumps as ledger activity hits peak, highlighting how changes in circulating supply metrics often coincide with shifting market conditions.

Potential Supply Imbalance on the Horizon

If demand increases while Binance balances remain compressed, the data points toward a potential supply imbalance scenario. Think of it like this: when there's less inventory on the shelves but customers keep walking through the door, something's got to give.

The reserve levels alone don't guarantee which direction prices will move, but they do illustrate how exchange liquidity conditions can significantly influence market dynamics around XRP trading activity. Traders watching these metrics are essentially looking for early warning signs of volatility—and right now, those signs are flashing.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova