XRP caught the crypto world off guard with an unprecedented surge in exchange reserves - the largest single jump ever documented. This massive inflow has traders and analysts scrambling for explanations. Are major exchanges gearing up for a wave of institutional demand, or does this spike hint at behind-the-scenes strategic moves that could reshape XRP's market dynamics?

Record-Breaking Reserve Growth

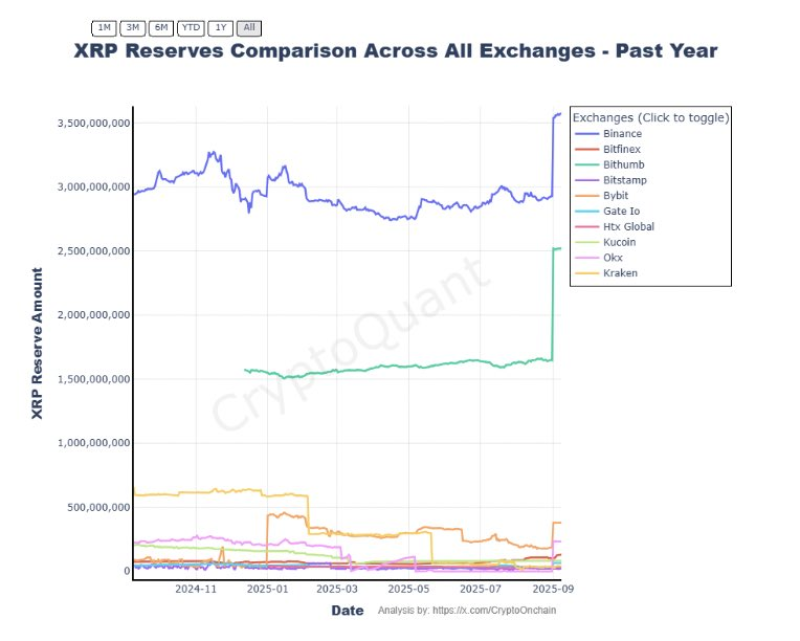

Data from ALLINCRYPTO reveals that XRP's exchange reserves exploded in what can only be described as a historic trading session. The charts show a dramatic vertical spike across multiple platforms, completely breaking the steady patterns we'd seen throughout 2025. Binance now sits on top with over 3.5 billion XRP, jumping from just above 3 billion almost overnight. Bitstamp and KuCoin also saw significant increases, while Kraken and smaller exchanges remained relatively unchanged after months of declining balances earlier this year.

What makes this particularly striking is that reserves had been fairly stable or even dropping since early 2025. This sudden reversal suggests exchanges are preparing for something big - potentially increased trading volumes or institutional activity that would require deeper liquidity pools.

Key Market Signals

- Months of stability followed by explosive growth in September 2025

- Largest documented inflow in XRP's recent trading history

- Major exchanges positioning for potential volatility or institutional flows

- Break from the declining trend that dominated early 2025

The timing and scale of this move strongly suggest that exchanges are anticipating significant market activity. Such dramatic liquidity positioning typically doesn't happen in a vacuum.

What's Driving This Shift

Several factors could explain why exchanges are suddenly stockpiling XRP. Recent regulatory clarity around digital assets has many institutions reconsidering their crypto strategies, and ETF momentum in the U.S. market is creating new pathways for mainstream investment. Exchanges might also be building deeper order books to handle potential surges in both retail and institutional trading without causing price disruptions.

The move comes at a time when the broader crypto market is showing signs of institutional maturation, with traditional finance increasingly embracing digital assets. XRP's recent legal victories and regulatory positioning make it an attractive option for institutions that previously stayed on the sidelines.

Looking Ahead

This historic reserve jump raises more questions than it answers, but that might be exactly the point. If major exchanges are positioning for institutional demand, XRP could be on the verge of a significant rally driven by real adoption rather than speculation. However, if this is simply a liquidity reshuffle or strategic repositioning, the market will need additional catalysts to sustain momentum.

What's clear is that XRP remains a central player in the evolving crypto landscape. Whether this reserve surge signals the beginning of a new growth phase or just smart preparation by exchanges, traders will be watching every move closely. The next few weeks could reveal whether this positioning pays off with increased trading activity and price action.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah