XRP (Ripple) explodes on Coinbase while big players quietly shift $500 million worth of tokens, setting up what could be the next major price rally.

Something interesting is happening with XRP right now. The token just hit #2 on Coinbase with $413 million in daily volume, but here's the kicker - whales moved over 167 million XRP tokens (worth nearly $500 million) between private wallets at the same time.

This creates a fascinating split. Regular traders are going crazy on exchanges, while the big money is moving coins off-exchange. When whales start accumulating quietly like this, it usually means they're preparing for something bigger.

The timing feels deliberate. Retail excitement is building momentum on public exchanges, but institutional players are positioning themselves away from all the noise. This kind of setup often leads to explosive price moves once the accumulation phase wraps up.

XRP (Ripple) Price Action Sparks Massive Derivatives Interest

Futures traders are getting excited too. Open Interest shot up 11% to hit $2.92 billion, which means more people are betting on big price swings coming soon. That's a lot of leverage building up on both sides of the market.

The surge in derivatives activity perfectly matches the whale movements we're seeing. Smart money often hedges their spot buying with futures positions, and when you see both happening together, it usually means something significant is brewing.

This isn't just random speculation either. The coordinated nature of spot accumulation and derivatives positioning suggests institutional players are preparing for a major move, not just taking quick profits.

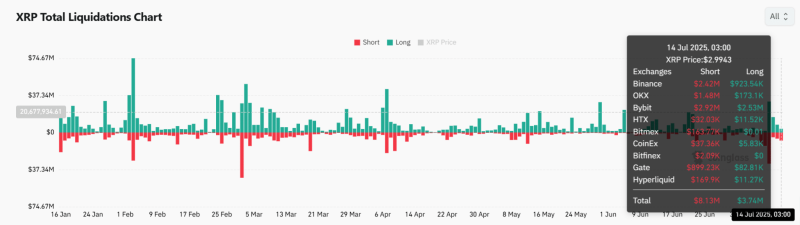

XRP (Ripple) Price Volatility Crushes Short Sellers

Bears got absolutely wrecked recently. Short liquidations hit $8.13 million compared to just $3.74 million in long liquidations across Bybit, OKX, and Binance. That's a serious short squeeze.

The timing lines up perfectly with XRP's Coinbase surge, suggesting either coordinated buying or momentum that caught shorts completely off guard. When you see liquidations this lopsided, it often triggers chain reactions that push prices even higher.

What makes this even more interesting is how it coincided with those massive whale transfers. Big players might have deliberately triggered these stops to scoop up more tokens at better prices while clearing out weak short positions.

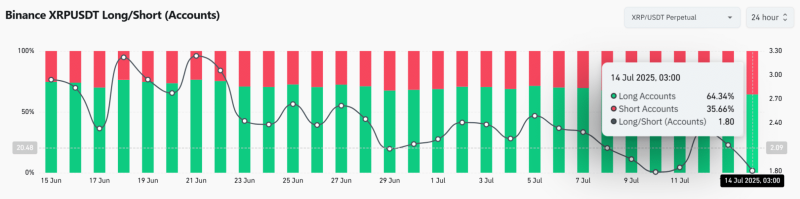

XRP (Ripple) Price Sentiment Stays Bullish Despite Mixed Signals

Binance data shows 64.34% of traders are long XRP, creating a 1.80 long/short ratio. That's solid bullish sentiment without being too euphoric - the sweet spot for sustainable moves up.

Exchange reserves are also climbing, which means people expect higher prices in the short term. But here's what's really interesting - while retail traders are optimistic and visible, whales are staying quiet and accumulating off-exchange.

This creates a perfect storm. Retail confidence supports current prices while institutional accumulation builds the foundation for bigger moves. When both groups align like this, XRP often sees significant rallies.

The current setup suggests we're moving from retail-driven momentum into strategic accumulation territory. Sure, there might be some short-term choppiness from all the leverage and liquidations, but the dominant theme is accumulation, not distribution.

Whales positioning quietly for sustained moves rather than quick flips usually signals longer-term bullish intentions. Combined with strong retail sentiment and short seller pain, XRP looks positioned for its next major rally once this accumulation phase completes.

Usman Salis

Usman Salis

Usman Salis

Usman Salis