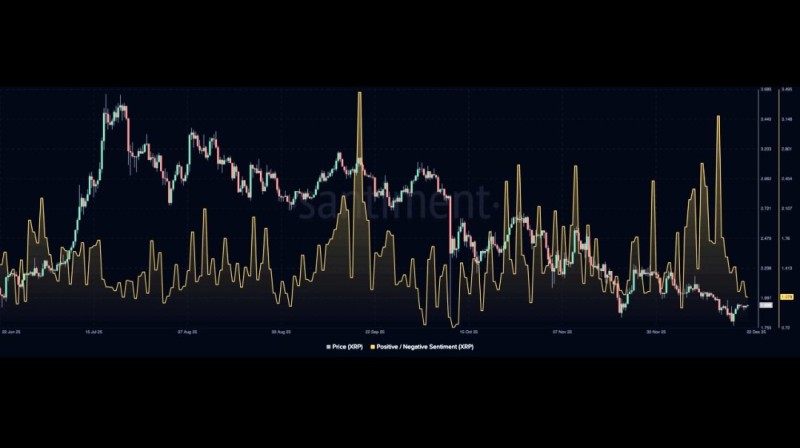

⬤ XRP is trading under heavy negative sentiment right now, with fear indicators hitting extremes. The sentiment-to-price correlation chart shows how these emotional peaks have lined up with major turning points before. According to market analysis, current fear levels match conditions that have historically come right before local bottoms or sparked quick relief moves.

⬤ Looking at the chart, you can see multiple moments where negative sentiment spiked hard just as XRP price was stabilizing or running out of downside steam. In past cycles, extreme fear showed up right before price either bottomed out locally or entered a temporary bounce. XRP hasn't confirmed any trend reversal yet, but the fact that fear is staying this high while price action remains relatively steady suggests sellers might be running out of energy rather than building up.

⬤ Recent price behavior looks more controlled than earlier drops—consolidation and lower volatility are the main themes. Meanwhile, sentiment stays wild and heavily negative, showing just how uncertain everyone feels. This gap between intense emotion and stable price is classic sentiment analysis territory. Fear tends to peak right before things start normalizing in the short term.

⬤ Why does this matter? Sentiment extremes drive short-term action, even when the bigger picture stays unclear. When fear gets this extreme, positioning becomes lopsided and even small demand shifts can trigger bigger moves. Sentiment alone won't tell you where the long-term trend goes, but right now XRP's setup shows how market psychology could shape what happens next as traders recalibrate their expectations.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets