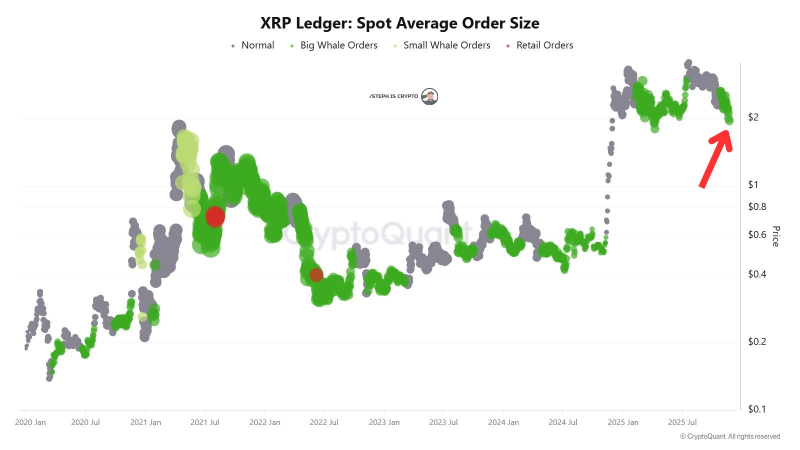

⬤ Fresh blockchain data from the XRP Ledger shows that major holders have been stepping up their game during the latest price drop. Whale-sized orders have become much more visible even as XRP keeps losing value. The data reveals a growing wave of high-volume transactions, pointing to accumulation activity while the overall price trend stays weak.

⬤ The charts paint an interesting picture: XRP has been drifting down from its recent peaks, unable to build any real momentum for a comeback. But here's the twist—whale orders, shown as those concentrated green and dark-green clusters, have clearly expanded. Meanwhile, smaller retail orders have practically disappeared, which means big players are now responsible for most of the trading action and they're soaking up available supply.

The divergence between declining prices and rising whale activity suggests institutional-level positioning during market weakness.

⬤ What makes this interesting is the gap between what the price is doing and what whales are doing. The price keeps falling, but major players keep buying more aggressively. While this doesn't guarantee an immediate turnaround, it does show that serious money has been getting more active as XRP approaches the bottom of its multi-month trading range. History shows us that similar buying patterns by large holders often happen during quiet, suppressed market periods before things eventually shift.

⬤ Because when the makeup of who's trading changes this dramatically, it can reshape how the market behaves. Whale buying during price drops often affects volatility patterns, available liquidity, and how quickly things might stabilize down the road. As traders watch for any signs of a potential bounce, this spike in large-volume orders gives us important clues about what's really happening beneath the surface in XRP's current market.

Peter Smith

Peter Smith

Peter Smith

Peter Smith